In the US and Canada, the tax rates vary depending on the taxing jurisdiction which is determined by user’s physical location. To apply taxes properly when customers have users in different locations, service providers can configure PortaBilling to assess taxes based on each user’s location. To identify the user’s location, the corresponding ZIP code must be specified for their account in PortaBilling.

Note that for now, this feature is available for SureTax and Compliance Solutions – CSI taxation plug-ins only.

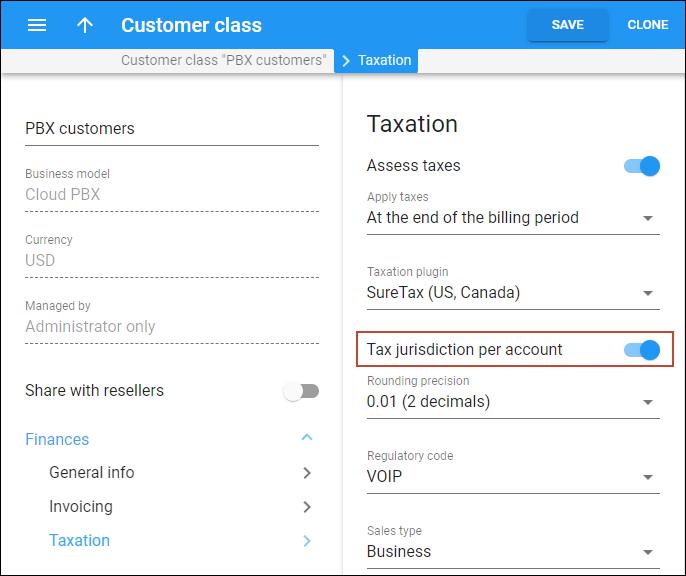

For example, a US service provider has the customer ABC located in New York (ZIP code 11413). Most of ABC’s employees work in the New York office, and two employees work remotely in Los Angeles (ZIP code 90011). By default, only the customer’s ZIP code is used to calculate taxes. For the tax management company to calculate taxes based on each employee’s location, the administrator first needs to make sure that the correct ZIP codes are set on employees’ accounts (Account > Personal info > General info > Address info > Postal code). The administrator adds missing ZIP codes to employees’ accounts – 11413 for employees in New York and 90011 for employees in Los Angeles. Then, the administrator enables the Tax jurisdiction per account option for the customer (via a customer class or directly).

As a result, different taxes are applied to accounts according to their tax jurisdiction. When the tax management company, e.g., SureTax, provides tax amounts to PortaBilling, taxation xDRs are created per account. Thus, the service provider can tax the ABC customer properly and report the correct data to the government authorities of New York and California.

- Proper tax calculation for customers with multiple locations.

- Service providers can correctly report taxes to the government authorities.

Specifics

- ZIP codes must be specified before the Tax jurisdiction per account option is enabled. If the customer’s accounts have no ZIP code specified, the customer ZIP code is used instead to assess the taxes, and the administrator receives the corresponding notification on email. If a ZIP code is missing for the customer, the taxes won’t be calculated and the customer’s invoice won’t be generated. The administrator receives the corresponding notification. After the administrator adds the missing ZIP code, the taxes are calculated with the next periodic statistics run (within 24 hours).

- Notifications about the missing ZIP code are enabled by default. If a ZIP code is changed in the middle of the billing period, the taxes are calculated based on the newest ZIP code.