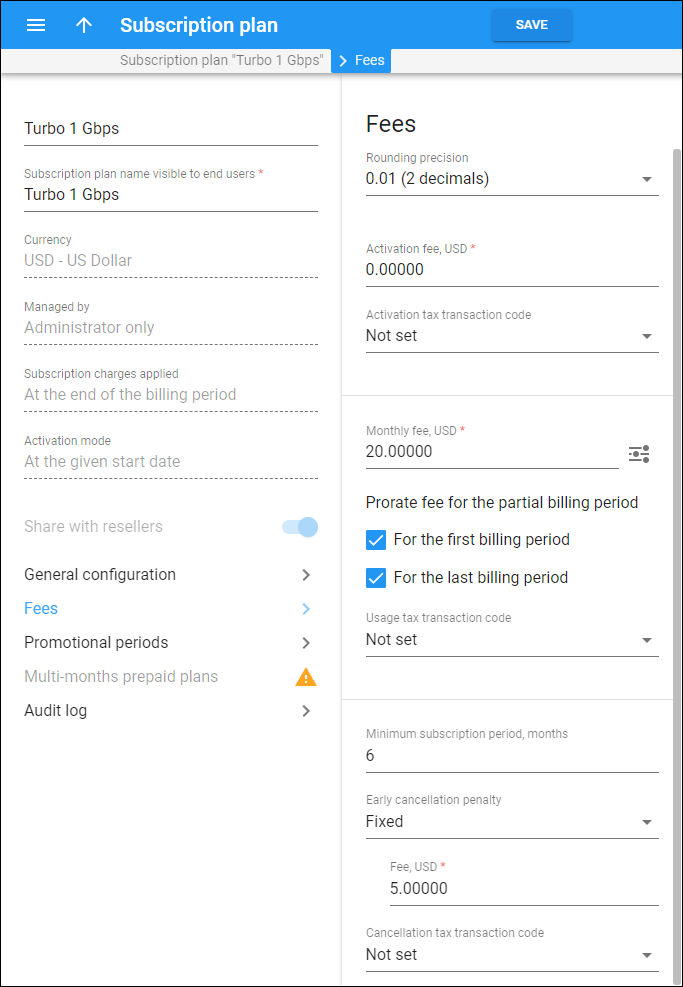

Rounding precision

Choose the number of decimals to round the charged amount for subscriptions in an individual xDR.

To select the rounding method for subscription charges, open the customer class and go to Finances > General info > Rounding method. The Away from zero rounding method is selected by default.

For example, if the Away from zero rounding method is selected and you select to round the charged amount to 0.01 (2 decimals) then 16.85306 rounds to 16.86.

Activation fee

This is a one-time fee that automatically applies when the subscription is activated.

Activation tax transaction code

Specify the internal tax transaction code from the list. PortaBilling uses this code to extract taxation codes for EZTax, Avalara, GST or SureTax taxation plug-ins and send them for tax processing for services covered by a subscription activation fee.

To create a tax transaction code, go to the Taxation panel.

Monthly fee

Change a monthly fee for this subscription. Click Adjustment to change periodic fees for non-monthly periods such as semimonthly, weekly, daily.

For example, if your monthly fee is $19.99, you may want to charge a higher weekly rate than $4.99, since the maintenance required by customers with shorter billing periods increases.

Daily fee

Change a daily fee for this subscription.

Prorate fee for the partial billing period

When a customer signs up for/cancels a subscription in the middle of a billing period, you can charge either a prorated or full periodic fee. By default, customers are charged a prorated fee based on the number of days the subscription is active during the first/last partial billing period.

- For the first billing period – select the checkbox to charge a prorated fee for the first billing period. Clear the checkbox to charge customers a full periodic fee, no matter when they activate their subscription.

- For the last billing period – select the checkbox to charge a prorated fee for the last billing period. Clear the checkbox to charge customers a full periodic fee, no matter when they cancel their subscription.

This option is available if you charge for subscriptions At the end of the billing period or In advance and is not available for Progressive (daily) subscriptions.

See the Periodic fee chapter for more information on prorated/full fee.

Usage tax transaction code

Specify the internal tax transaction code from the list. PortaBilling uses this code to extract taxation codes for EZTax, Avalara, GST or SureTax taxation plug-ins and send them for tax processing for services covered by the periodic subscription fees.

To create a tax transaction code, go to the Taxation panel.

Minimum subscription period, months

Specify the time interval in months. During this period the subscription must remain uninterrupted to avoid penalties.

This field is mandatory for further configuring a commitment (discounted subscription rate). Define a minimum subscription period, e.g., 24 (months), to calculate possible cancellation penalties. This means that the discount will end in 24 months.

Early cancellation penalty

This is a one-time fee that applies if the subscription is cancelled before the minimum subscription period ends.

-

Fixed – this is the charge you apply to a customer for early cancellation. It is fixed, regardless of the number of months/days left when the customer ends their subscription.

-

Remaining subscription charges – the charge depends on the periods remaining.

For example, imagine the customer's $5 subscription must be active for 10 months but they cancel it after 6 months. The customer's cancellation penalty is $20, which is the sum of charges for the remaining 4 months (4*$5=$20).

-

Sum of discounts applied – this charge depends on the billing periods during which the customer used the service. A penalty is determined by the sum of all the discounts provided to the customer since they signed up for the subscription.

Select this option if you further configure the commitment (discounted subscription rate). For example, John Doe decides to cancel his 24-month commitment after 20 months of usage. According to his package conditions, he received a $5 discount and therefore, paid $15 per month instead of $20. So John's penalty is $100, which is the sum of the discounts for his 20 months of service usage (20*$5=$100).

Cancellation tax transaction code

Specify the internal tax transaction code from the list. PortaBilling uses this code to extract taxation codes for EZTax, Avalara, GST or SureTax taxation plug-ins and send them for tax processing for services covered by the subscription cancellation fee (e.g., administrative costs).