Automatically generated

Regular invoices

“Regular” invoices are the most common invoice type. These invoices:

- Are generated automatically for each billing period, e.g., monthly, upon the billing period closure. For example, if a customer has a monthly billing period, their invoice for March will be generated on April 1st. Note that the exact time of the invoice generation depends on the system configuration and load.

- Include all transactions such as pay-as-you-go charges, subscriptions, credits/refunds, that have been made before the end of the billing period. Additionally, to provide correct information about the amount due, the invoices may include automatic credit card payments, and other payments received during the period.

- Commonly include the outstanding debt from the previous billing period (see the amount due calculation configuration).

- Optionally, can require the admin’s review and approval before being to customers.

Invoice generation date is a starting point for the payment collection process. You can define the number of days within which the payment is expected after the invoice generation and configure what notifications and actions will be used if payment is past due.

Generated on-demand

In addition to the automatically generated regular invoices, you can manually generate initial, midterm, and out-of-turn invoices on demand.

Let’s explore when each of these types is useful.

Initial invoices

You may need to generate an invoice immediately after the customer creation. For example, a customer signs up via an online portal and has to pay for service activation and the first service period – in this case, we need to produce subscription charges, assess taxes, etc., to provide the correct total to receive this payment. This type of invoice is referred to as the “initial” invoice.

An initial invoice:

- Can be generated only once for a new customer – during the first billing period.

- Includes all the charges that have already been applied in the first billing period. Typically, these are one-time charges (e.g., for the purchased IP phones), subscription charges (e.g., an activation fee or a subscription fee applied in-advance). The initial invoice will also include pay-as-you-go charges for the services (e.g., voice calls) that have already been consumed before the invoice generation.

The regular invoice that will be automatically generated at the end of the billing period will include only the charges applied after the initial invoice generation (e.g., for voice calls made during the month).

Say a customer signs up for the cloud PBX service through a CloudPBX Signup Portal. They choose a service package with a $100 monthly fee charged in advance and order IP phones worth $400. The portal automatically creates the corresponding customer record in the system and the system instantly generates an initial invoice that includes the subscription fee for the first month ($100), the cost of the ordered IP phones ($400), and automatically assessed taxes (e.g., $50). The portal then displays the total invoice amount ($550), allowing the customer to make an immediate payment via credit card. A successful payment activates the customer’s service and completes their IP phone order.

An initial invoice allows for generating an invoice with a correct total (e.g., with taxes) immediately upon creating a new customer and improving the service provider’s cash-flow. It is a convenient way for automated sign-ups, hardware purchases during activation, subscriptions applied in advance, etc.

Midterm invoices

You have an option to manually generate an invoice before the end of a billing period. For instance, if the customer’s credit limit is almost used up and they wish to pay for the already consumed services to prevent service interruption.

A “midterm” invoice:

- Can be generated anytime before the end of the billing period.

- Includes charges that have been applied starting from the first day of the billing period until the invoice generation date. For example, if a monthly billing period starts on March 1st and the admin generates a midterm invoice on March 18th, the invoice will include charges for the period from March 1st to the moment on March 18th when the invoice is generated.

The remaining billing period will be covered by the regular invoice that will be automatically generated at the end of the billing period.

Say in June a customer experiences unexpectedly high service usage on one of their accounts. Eventually, on June 20th, the customer receives a notification that their credit limit is expected to be exceeded soon, so they may no longer be able to use the services. To avoid this, the customer contacts the service provider and requests an invoice so their financial department can pay for the services used from the beginning of June up to the current date. To address this, the service provider’s admin generates a midterm invoice covering the period from June 1st to June 20th, which is then sent to the customer. Once the payment is received, the customer’s balance decreases, allowing the customer to continue using the services.

Midterm invoices enable service providers to meet the customer needs by allowing them to settle several smaller invoices, rather than a single large one, even if the total amount due is the same.

Out-of-turn invoices

Sometimes, invoices for one-time extra services such as a technician visit or an equipment purchase need to be issued separately and at the time when such service is rendered. This allows the customer to proceed with the payment immediately. In such cases, you can generate an “out-of-turn” invoice.

An “out-of-turn” invoice:

- Can be generated anytime before the end of the billing period.

- Includes only hand-picked manual credits and charges made in the current billing period.

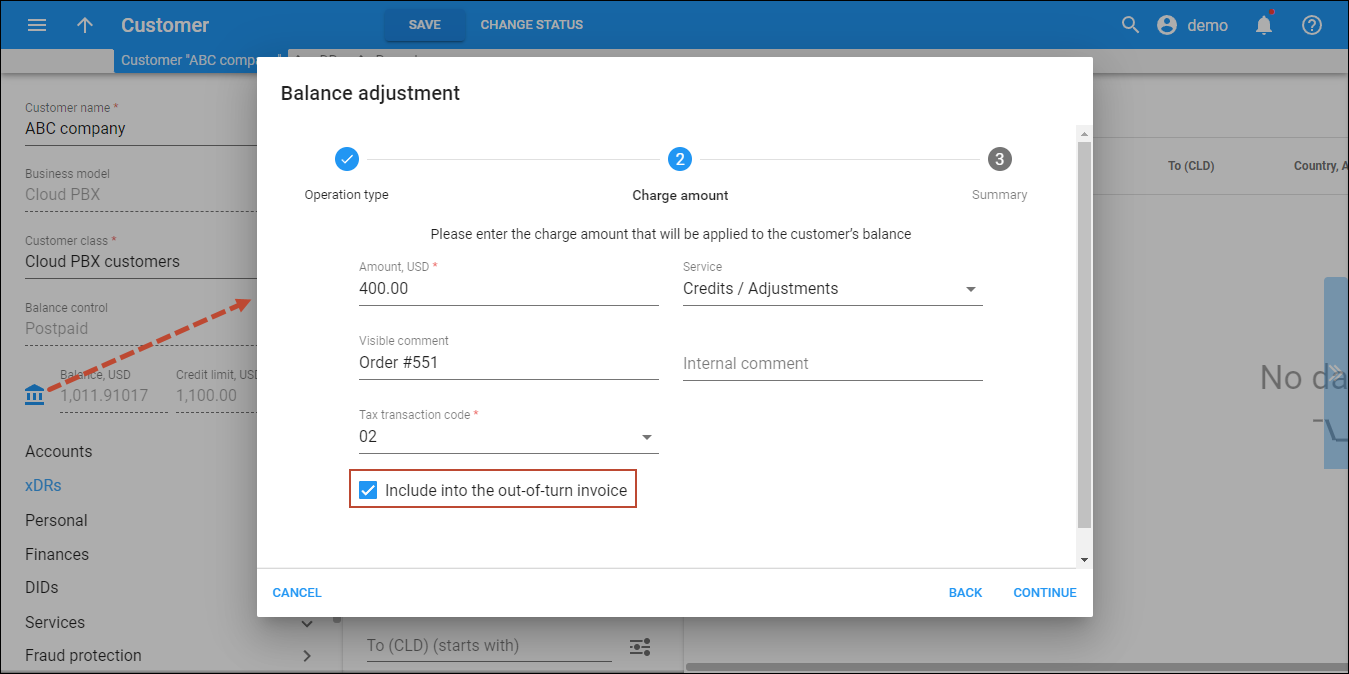

To be able to pick a charge/credit for an out-of-turn invoice, select the “Include in the out-of-turn invoice” checkbox in the “Balance adjustment” dialog when manually applying the charge/credit.

Similarly to initial and midterm invoices, the transactions (charges/credits) that were not included in an out-of-turn invoice will be reflected in the regular invoice issued at the end of the customer’s billing period.

Example 1

Let’s say your existing customer orders 10 additional IP phones worth $400 for their new employees. To bill the customer for these IP phones, the service provider’s admin first navigates to the customer’s page and applies a $400 “Manual Charge” transaction. In the “Visible comment” field, they specify the order number (e.g., #551), which will be visible to the customer on the invoice. To ensure this transaction can be later included in an out-of-turn invoice, the admin selects the “Include in the out-of-turn invoice” checkbox.

After that, the admin generates an out-of-turn invoice with the selected charge. Upon receiving this invoice, the customer can see the charged amount along with the order number. Once the invoice is settled, the service provider ships the IP phones to the customer.

Example 2

Let’s say the customer receives an out-of-turn invoice for the purchase of IP phones (see Example 1) and finds out that the agreed-upon discount with the service provider has not applied, resulting in an overcharge. To address this issue, the admin applies a manual credit to the customer’s balance to compensate for the discount amount that was not initially applied. Then, to provide the customer with an immediate confirmation that the issue has been resolved, the admin generates a new out-of-turn invoice with the credit amount. This way, the customer’s accounting department doesn’t have to wait till the end of the billing period to track the credit transaction and can process this invoice separately from the regular invoice to avoid discrepancies.

Back to main menu

Back to main menu