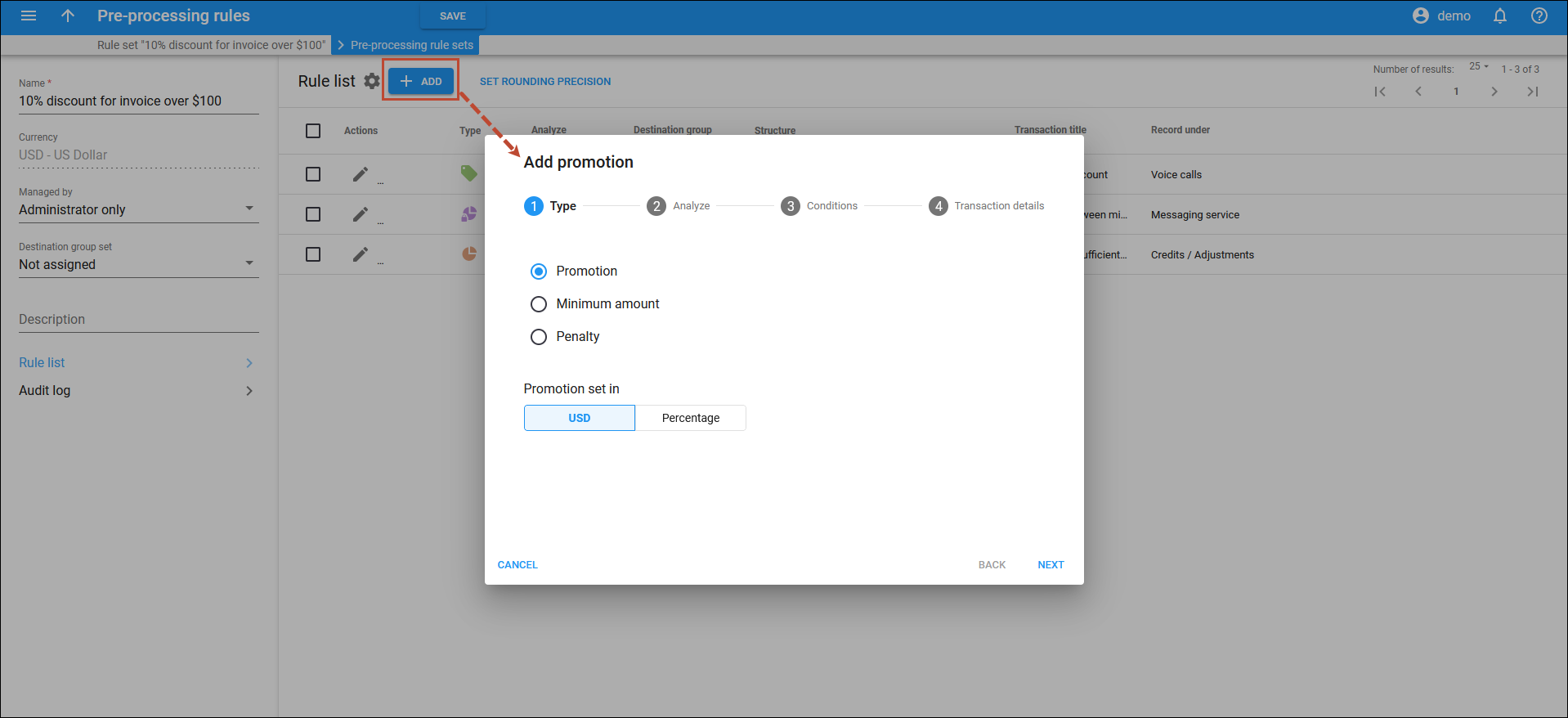

To add a new invoice pre-processing rule, click Add on the Rule list panel and specify the rule details.

Type

Choose the type of the invoice-preprocessing rule:

Promotion – provides a promotional credit if the billed amount or service usage reaches the specified threshold.

Promotion – provides a promotional credit if the billed amount or service usage reaches the specified threshold. Minimum amount – defines the minimum spending threshold. If the customer’s spending falls short of this threshold, the difference between the threshold and the actual charged amount will be automatically added to the bill.

Minimum amount – defines the minimum spending threshold. If the customer’s spending falls short of this threshold, the difference between the threshold and the actual charged amount will be automatically added to the bill. Penalty – applies a penalty (fixed amount or percentage) on top of the billed amount if the specified threshold is not reached.

Penalty – applies a penalty (fixed amount or percentage) on top of the billed amount if the specified threshold is not reached.

Promotion/Penalty set in

Select how the promotion/penalty is calculated:

- Amount of money

- Percentage

Click Next.

Analyze

Select what the system should analyze to check whether the threshold has been is reached:

- Total charges (the sum of per-usage service charges, subscriptions, and credits/adjustments in the invoice). This option is available for the Promotion and Penalty rule type

- Total for a specific transaction type (e.g., subscriptions)

- Usage of a specific service (e.g., voice calls)

Destination group

You can select a destination group that includes destinations to which the invoice pre-processing rule should apply. For example, to offer a promotion if the customer spends $50 or more on international voice calls, select a destination group that includes phone prefixes for international calls.

Note that you can only select a destination group, if the corresponding destination group set is associated with the invoice pre-processing rule set.

Measure usage in

This option is available for the Promotion and Penalty rule type. Choose in which units the threshold is measured:

- Monetary – select to define the threshold in the amount of money.

- Service units – select to define the threshold in the number of service units, e.g., minutes for voice calls.

Click Next.

Conditions

Configure the conditions for a specific rule type. To add another rule condition (e.g., to configure multiple thresholds for giving promotional credits), click Add  . To delete a condition, click Delete

. To delete a condition, click Delete ![]() .

.

Promotion

If the usage reaches

Specify the threshold that should be reached for the promotion credit to apply.

Apply credit (discount)

Specify the promotional credit (the amount of money or a percentage) to subtract from the invoice total.

Apply credit (discount) to service

Select whether the system should apply the promotional credit to:

- Total charges

- Total for a specific transaction type (e.g., subscriptions)

- Specific service (e.g., voice calls)

Apply to subscription

When applying the promotional credit to subscriptions, you can choose to apply it to the total subscription charges or to a specific subscription fee (select the corresponding subscription name in the dropdown list).

Minimum amount

If the sum of charges for the billing period is

Set the upper threshold that should be reached. If the customer spends less on the chosen service than the specified value, the difference between the threshold and actual charged amount will be added to the bill.

Penalty

If the amount does not reach

Specify the threshold value that should be reached. If the threshold is not met, the penalty will apply.

Apply penalty

Specify the penalty (fixed amount or percentage) that will be added on top of the billed amount.

Apply charge to service

Select whether the system should apply the penalty to:

- Total for a specific transaction type (e.g., subscriptions)

- Specific service (e.g., voice calls)

Apply to subscription

When applying the penalty to subscriptions, you can choose to apply it to the total subscription charges or to a specific subscription fee (select the corresponding subscription name in the dropdown list).

Click Next.

Transaction details

Apply to service

This shows to which service the promotional credit or charge will be applied.

Transaction title

Specify the comment that will appear on the invoice for the transaction generated by applying the invoice pre-processing rule.

Tax transaction code

Select a tax transaction code. It’s an internal code mapped to the actual tax code of the taxation system you use (e.g., SureTax).

To create a tax transaction code, go to the Taxation panel.