SureTax is another taxation system that allows you to accurately and easily calculate taxes for your US and Canada customers.

You can use this taxation method to tax services (e.g., voice calls, DID usage, etc.), subscriptions, bundle promotions and payments. SureTax (as a taxation method) can be defined within the customer class or for the individual customer.

When you select SureTax as a taxation plug-in, you can define such parameters as:

- type of customer;

- summary type;

- type of tax exemption.

Rounding

SureTax uses mathematical rounding on tax amounts. For example, if you configure to round the charged amount to two decimal digits, then 1.204 rounds to 1.20, 1.205, and 1.206 all round to 1.21.

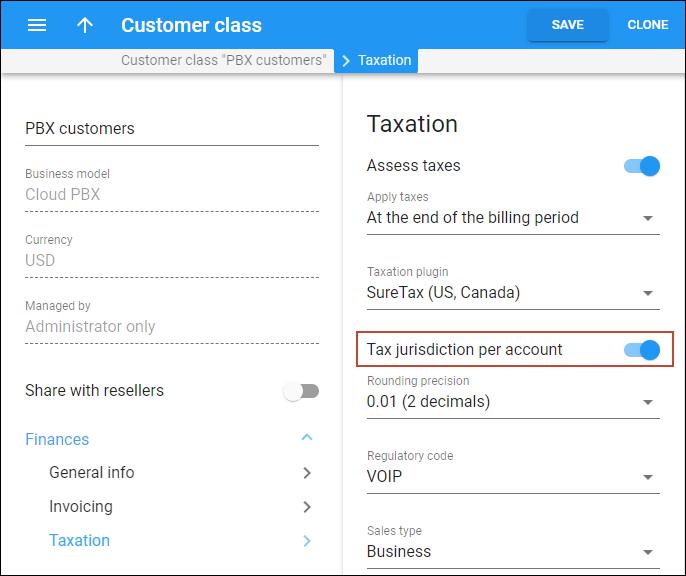

You can choose the number of decimals to round the tax amount in the Rounding precision option in the customer class or for the individual customer.

SureTax plug-in tax calculation based on user location

In the US and Canada, the tax rates vary depending on the taxing jurisdiction which is determined by user’s physical location. To apply taxes properly when customers have users in different locations, service providers can configure PortaBilling to assess taxes based on each user’s location. To identify the user’s location, the corresponding ZIP code must be specified for their account in PortaBilling.

Note that for now, this feature is available for SureTax taxation plug-in only.

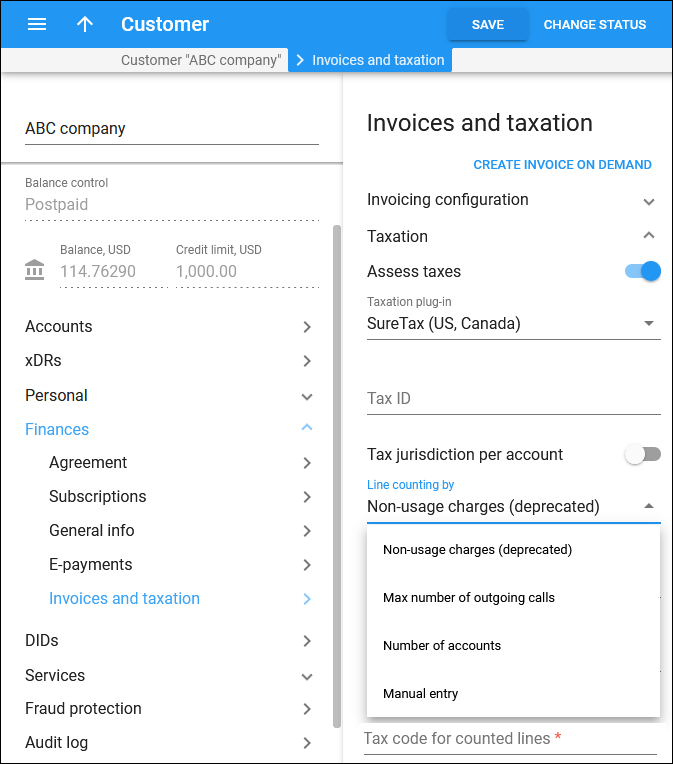

For example, a US service provider has the customer ABC located in New York (ZIP code 11413). Most of ABC’s employees work in the New York office, and two employees work remotely in Los Angeles (ZIP code 90011). By default, only the customer’s ZIP code is used to calculate taxes. For SureTax to calculate taxes based on each employee’s location, the administrator first needs to make sure that the correct ZIP codes are set on employees’ accounts (Account > Personal info > General info > Address info > Postal code). The administrator adds missing ZIP codes to employees’ accounts – 11413 for employees in New York and 90011 for employees in Los Angeles. Then, the administrator enables the Tax jurisdiction per account option for the customer (via a customer class or directly).

As a result, different taxes are applied to accounts according to their tax jurisdiction. When SureTax provides tax amounts to PortaBilling, taxation xDRs are created per account. Thus, the service provider can tax the ABC customer properly and report the correct data to the government authorities of New York and California.

- Proper tax calculation for customers with multiple locations.

- Service providers can correctly report taxes to the government authorities.

Specifics

- ZIP codes must be specified before the Tax jurisdiction per account option is enabled. If the customer’s accounts have no ZIP code specified, the customer ZIP code is used instead to assess the taxes, and the administrator receives the corresponding notification on email. If a ZIP code is missing for the customer, the taxes won’t be calculated and the customer’s invoice won’t be generated. The administrator receives the corresponding notification. After the administrator adds the missing ZIP code, the taxes are calculated with the next periodic statistics run (within 24 hours).

- Notifications about the missing ZIP code are enabled by default. If a ZIP code is changed in the middle of the billing period, the taxes are calculated based on the newest ZIP code.

Per-line tax calculation for SureTax plug-in

Service providers in the US have to assess certain taxes (e.g. E911 surcharge) based on the number of customer’s service lines (per-line taxes). Since the tax law does not refer to hosted PBX concepts, it is important to correctly translate the actual hosted PBX configuration (the type of the business/product; number of phone lines, allowed to make phone calls; the maximum number of allowed outgoing calls; etc.) into the number of lines used for taxation.

PortaBilling automatically calculates the number of lines to be passed to the taxation engine using either of 2 methods:

- Count all customer accounts, enabled for making phone calls. This is good for a typical hosted PBX environment when each account represents a phone line, assigned to an individual and provisioned on a VoIP phone or mobile app. Certain accounts (e.g. auto-attendant) can be excluded from the calculations.

- Use the maximum number of allowed outgoing calls for an account. This is useful for SIP trunking service when a single account represents a remote PBX with multiple users on it.

In case a customer has a complex configuration of the hosted PBX environment and it is not possible to correctly calculate the number of lines automatically – an administrator can manually assign the required value.

Benefits

- Service providers comply with the government regulation for calculating lines.

- Correct per-line tax calculation with the tax cap which can result in reduced tax amounts for customers.

Note that for now, this feature is available for SureTax taxation plug-in only.

Scenario 1

Let’s say a US service provider has a customer “ABC” located in two offices. The Dallas office (ZIP code 75043) has 150 employees and 100 employees work in the Denver office (ZIP code 80022). The tax calculation depending on the users’ physical location (Texas or Colorado) is enabled for “ABC”. According to the tax jurisdiction, the following 911 per-line taxes are applied to “ABC”:

- Dallas: $0.5 per line.

- Denver: $1.2 per line but the tax cap is $100 in total per customer.

Since each employee uses a phone line (account) provisioned on an IP phone, the per-line taxation based on the number of accounts makes the most sense and so it is set in the customer settings. So when closing a billing period for the customer, PortaBilling sends a request to SureTax with the following information:

- Dallas: ZIP code 75043 – 150 lines

- Denver: ZIP code 80022 – 100 lines

SureTax calculates the corresponding amounts of E911 tax:

- Dallas – $75 (150 lines*$0.5)

- Denver – $100 (100 lines*$1.2=$120, but no more than $100 in total per customer)

Scenario 2

Let’s say a US service provider has a customer “XYZ” located in Dallas (ZIP code 75043). “XYZ” has their own PBX, so they use SIP trunking service to send/deliver calls from/to their PBX.

Since “XYZ” customer has a single account in PortaBilling which represents a remote PBX with multiple XYZ’s employees who can make calls, it makes sense to use the number of concurrent outgoing calls allowed for the remote PBX as a number of lines used for taxation. For the “XYZ” customer, this number is set to 20.

The tax calculation depending on the users’ physical location is disabled for this customer.

PortaBilling sends the request to SureTax with the following information:

- Dallas: ZIP code 75043 – 20 lines

According to the tax jurisdiction (Dallas, Texas), $1.2 per-line 911 tax is applied, so SureTax calculates the corresponding amount of E911 tax:

- Dallas – $24 (20 lines*$1.2=$24)

For example, a customer has 10 users in different locations and the Tax jurisdiction per account option is enabled. Each account is allowed to make 4 simultaneous calls (on the product level); however, the number of allowed outgoing calls is also restricted to 8 calls (on the customer level).

As the number of lines is sent per each user location and checked against the customer limit, the final number of lines reported will be 40 (each account will be reported as 4 lines), though in reality, it will be possible to make only 8 simultaneous calls.

In all the above scenarios, when SureTax assesses the per-line tax and provides tax amounts, PortaBilling creates tax xDRs, adjusts customer balance, and generates the invoice at the end of the billing period which includes these tax amounts.

Thus, the service providers can collect per-line taxes from the customer properly and in accordance with the corresponding regulations.

Configuration

To configure the per-line tax calculation for the customer (via a customer class or directly), the administrator needs to perform the following steps:

- Open a specific Customer record (or a specific Customer class) > Finances > Invoices and Taxation > Taxation > select the needed Line counting by option (“Max number of outgoing calls”, “Number of accounts”, or “Manual entry”). Note that the “Manual entry” can only be selected for a specific customer and is unavailable for a customer class. When the administrator selects this option, they need to specify the number of lines with the corresponding ZIP code to be passed to SureTax.

- Specify the tax code in the Tax code for counted lines field. Contact SureTax support team to obtain the tax code to assess per-line taxes.

Specifics

If Tax jurisdiction per account option is enabled for the customer and the customer’s accounts have no ZIP code specified, the customer ZIP code is used instead to send the number of lines to the tax company, and the administrator receives the corresponding notification on email.