Service providers operating in Singapore can assess Goods and Services Tax (GST) for their customers. GST is levied on services consumed domestically, e.g., voice calls and messages between users in Singapore.

To access GST, a service provider enables the GST plug-in on the PortaBilling web interface and sets the current GST rate, e.g., 7%, globally (for all billing environments). It’s possible to prepare for upcoming changes to the GST rate in Singapore by presetting a new rate with an "effective from" date (e.g., 8% starting from January 1, 2023), and the new rate will be automatically applied starting from the desired date.

The GST plug-in automatically applies the set rate to domestic service (calls and messages made within Singapore) or zero rate to international service (e.g., when a user from Singapore makes a call or sends a message to a non-Singapore number).

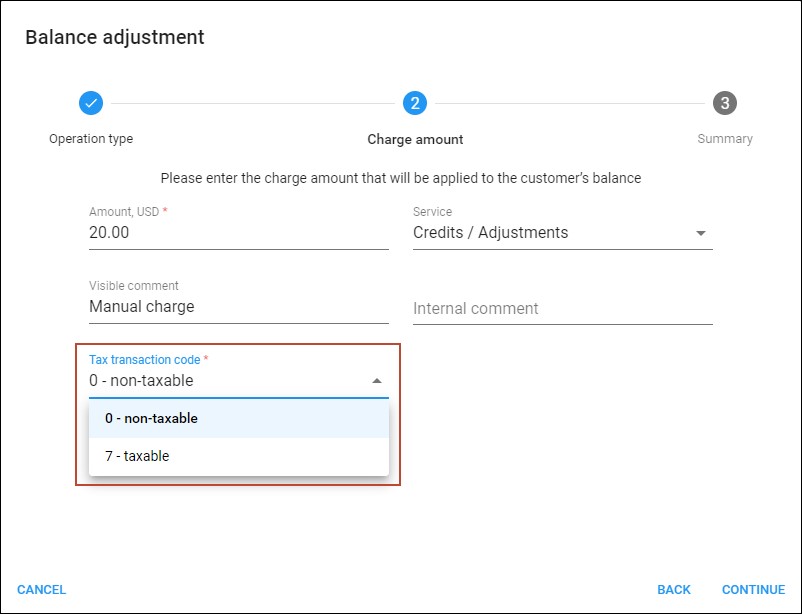

Applying GST to different types of charges, e.g., manual charges applied by the administrator, is determined by the tax code used with the charge (the tax code value equals the GST rate, e.g., tax code “0” means zero-rated tax).

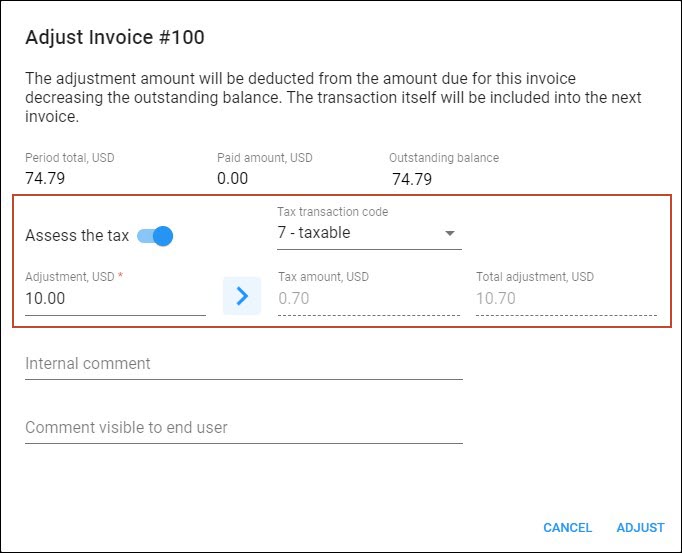

In case the administrator needs to adjust the amount to be paid in invoice, it’s possible to automatically add GST on top of the adjustment amount to ensure correct calculations.

Service providers that operate in Singapore can comply with local tax regulations.

Configuration

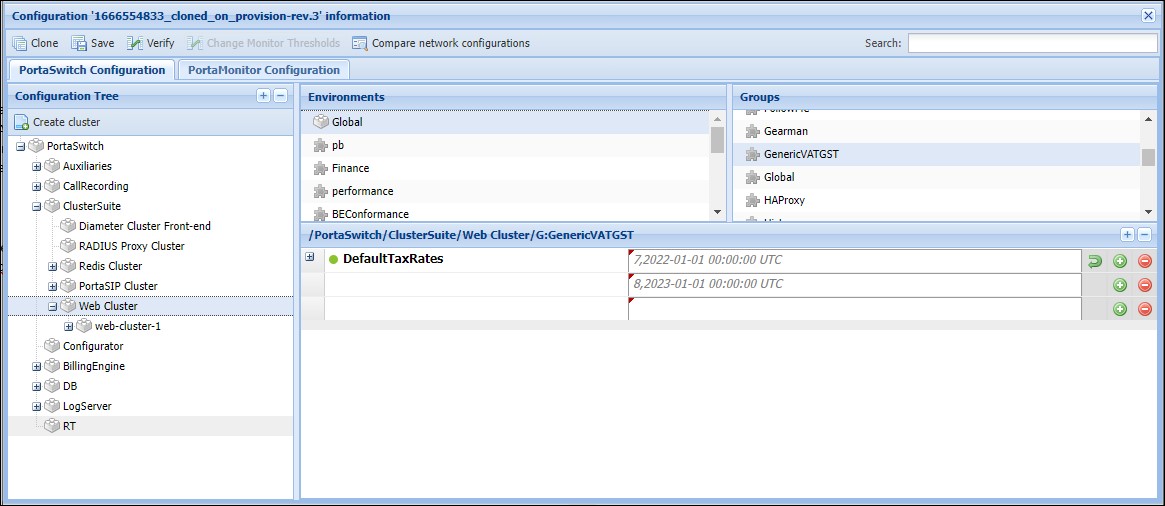

On the Configuration server web interface, specify the current GST rate defined by the government (and upcoming rates, if any changes are announced) using the GenericVATGST.DefaultTaxRates option. Specify the date/time when each rate becomes effective.

On the PortaBilling web interface:

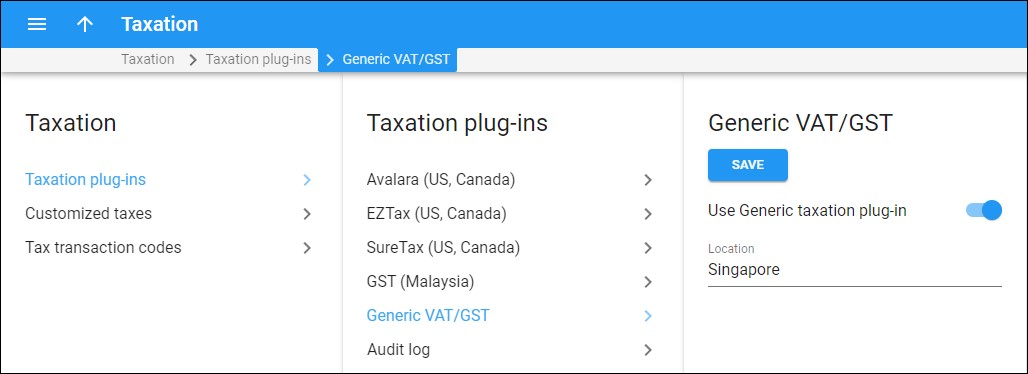

- Enable the GST plug-in. Open Finance > Taxation > Generic VAT/GST > turn on the Use Generic taxation plug-in toggle > specify the location: “Singapore”.

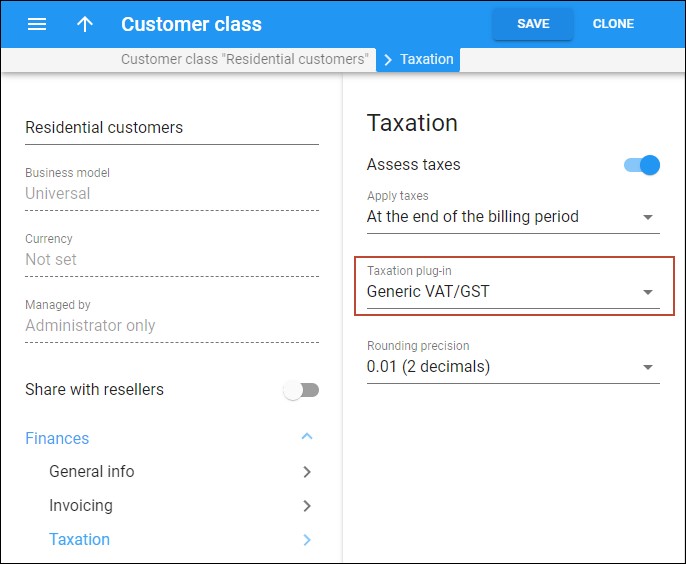

- Configure GST taxation for a customer class (it can be overridden for a specific customer). Open Customer class > Finances > Taxation > enable the Assess taxes toggle > select the Generic VAT/GST taxation plug-in.

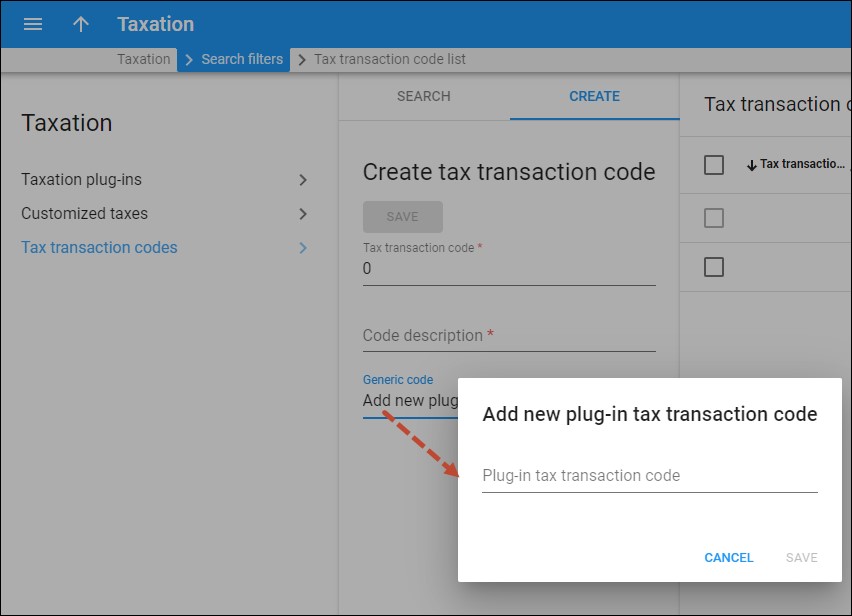

- Create tax codes to apply GST to different types of charges.

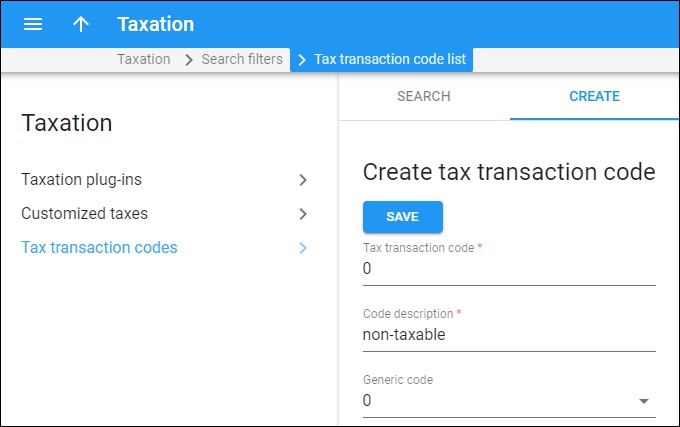

- Create tax plug-in codes. The tax plug-in code value equals the GST rate, so you can create two tax codes: for domestic service (e.g., “7” means the GST rate 7%) and for international service (“0” means zero-rated tax). Open Taxation > Tax transaction codes > Create > Generic code > Add new plug-in tax transaction code > add two codes, e.g., “0” and “7”.

- Create tax transaction codes (e.g., corresponding to “0” and “7” plug-in tax codes). On the Create tax transaction code panel, fill in the Tax transaction code and Code description fields, select the corresponding tax plug-in code (Generic code), and click Save.

Now, it’s possible to apply one of these tax codes to different types of charges, e.g., a manual charge (depending on whether a charge is related to domestic or international service).

Adding GST when adjusting an invoice amount

To add GST when adjusting the invoice amount, the administrator needs to:

- choose the invoice to adjust in the list, hover over it, click Action menu

and select Adjust

;

; - in the Adjust invoice dialog, specify the adjustment amount;

- enable the Assess the tax toggle;

- select the tax transaction code;

- click Arrow

to calculate the tax; and

to calculate the tax; and - click Adjust.

Thus, the GST amount will be automatically added on top of the adjustment amount for the correct calculation.

Specifics

- Calls and messages where the calling number is unknown (the country can’t be identified) are considered as domestic service if the other number is identified as Singaporean.

- For charges, such as recurring subscription fees that can’t be automatically identified as domestic or international, the default GST rate (domestic) is applied. The administrator can override it with a zero rate by applying a manually created tax transaction code.

- Tax xDRs are created per service.

Rounding

The rounding type (round upward or apply mathematical rounding) for the GST plug-in depends on the settings on the Configuration server (the value of the Stats.Tax_Rounding_Method option).

By default, the tax amount rounds upward. For example, the rounding precision set for the GST plug-in (Customer class > Finances > Taxation > Rounding precision) is 0.01 (2 decimals), then 1.204, 1.205, and 1.206 all round up to 1.21. If you change the default rounding method to mathematical rounding, then 1.204 will be rounded to 1.20, and 1.205 and 1.206 will be rounded to 1.21.