Prepaid services enable Internet telephony service providers (ITSPs) to offer calling card services that customers can pay for in advance.

The market for prepaid services includes tourists, immigrant communities, mobile populations such as military personnel, and people with limited credit histories who cannot otherwise get a private telephone line in their homes.

For example, you to sell prepaid calling cards that offer cheap calls for users all over the world via either local or toll-free telephone (access) numbers.

Each card has one or several access numbers printed on it that a user can dial to access the service. Once the call connects, the user enters their personal identification number (PIN) and the phone number of the contact they wish to reach. The charge for the call is then withdrawn from the user’s prepaid calling card.

Separate charge for incoming leg in the prepaid card application

As a rule, telecom operators do not charge users for calls to access numbers (either local or toll-free). However, your carrier may charge you for delivering incoming calls to an access number (e.g., you own a toll-free number, or your costs depend on origination locations).

With PortaSwitch you have two ways to cover the incoming call cost:

- You include the cost of an incoming call into the price for an outgoing call (a call to a destination number). In this case, one xDR is created.This could cause service abuse, since some users may call the access number only to check their balance and not make a further outgoing call.

- You provide a separate price for an incoming call leg (leg A) and therefore you charge users for both incoming and outgoing (leg B) call legs. In this case, two xDRs are created.

Find how to configure the prepaid card application to apply a separate charge for incoming call legs in the How to… section of the Prepaid Services handbook.

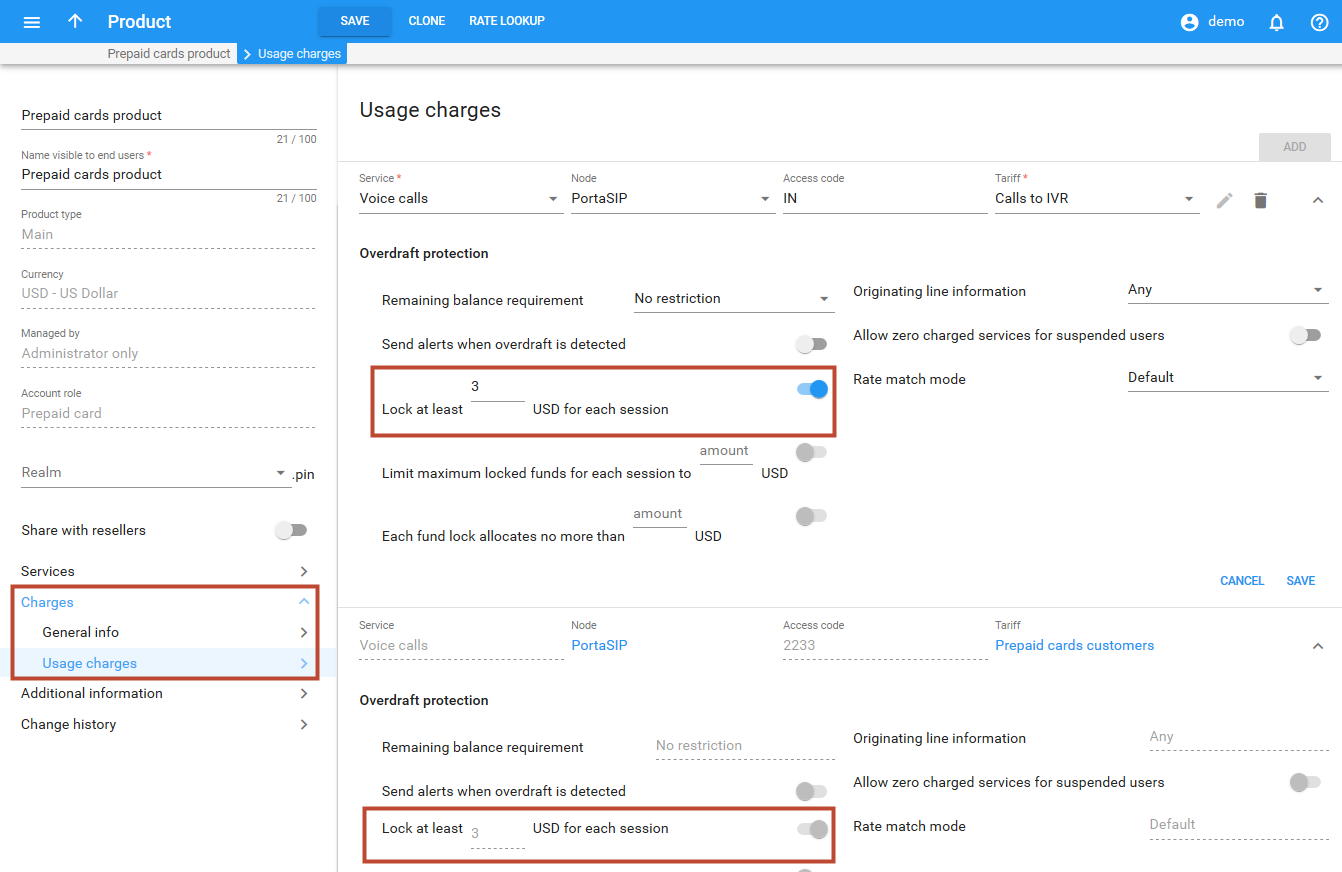

Let’s see how the charges for a call are calculated when a user, John Doe, makes several calls (e.g., +442087677788, +331085577338) using a prepaid card with a $15 balance. For simplicity’s sake, the price for incoming calls to the IVR (2233) is $1 per minute and the calls to London and France cost $2 per minute. Overdraft protection is set to lock at least $3 for every session.

- John Doe dials the 2233 access number and listens to the welcome IVR prompt during 1 minute. He starts the session with a price of $1 per minute for the incoming call to the IVR.

- John enters the PIN. Now he is authorized.

- PortaBilling locks $3 for this call to the IVR according to the overdraft protection settings.

- John listens to the IVR prompts during 1 minute more. This is the 2nd minute of calling the IVR.

- John dials the destination number +442087677788 to call his mother in London.

- PortaBilling locks $15 and authorizes the call to London for 4.3 minutes. The call duration is calculated based on the card’s balance and tariff rates, plus PortaBilling considers the call to the IVR which is still in progress. The call covers:

- The call to London (+442087677788) for 4.3 minutes (4.3 min*$2=$8.6).

- The call to the IVR (2233) for 6.3 minutes ((4.3 min for the call to London + 2 min for the call to the IVR)*1$=$6.3).

- John disconnects the call to London after 1 minute.

- PortaBilling creates an xDR for the call to London for $2 (1 min*$2=$2).

- PortaBilling reduces the locked amount to $3 according to the overdraft protection settings.

- John’s available funds are now $13 ($15-$2).

- John listens to the IVR prompts during 1 minute more. This is the 4th minute he spends calling the IVR.

- John dials another destination number +331085577338 to call his friend in France.

- PortaBilling locks $13 and authorizes the call to France for 3 minutes. The call covers:

- The call to France (+331085577338) for 3 minutes (3 min*$2=$6).

- The call to the IVR (2233) for 7 minutes ((3 min for the call to France + 4 min already spent for the call to the IVR)*1$=$7).

- John disconnects the call to France after 1 minute.

- PortaBilling creates an xDR for the call to France for $2 (1 min*$2=$2).

- PortaBilling reduces the locked amount to $3 according to the overdraft protection settings.

- John’s available funds are now $11 ($13-$2).

- John listens to the IVR prompts during 1 minute more. This is the 6th minute he spends calling the IVR.

- John disconnects the session.

- PortaBilling creates an xDR for the entire incoming call to the IVR for $6 (6 min*$1=$6).

- John now has $5 available.

With the PortaSwitch Prepaid card IVR application you can offer various products, manage prices for calling card services without administrative overwhelm and therefore increase your revenue. For more details on configuration options see the Prepaid calling IVR applications section.

Prepaid card ANI number reassignment provisioned via the self-care menu

Depending on their business models, ITSPs can configure PINless dialing service so that customers who purchase a new prepaid card must reassign the ANI number associated with the previous card to the new card.

ANI number reassignment takes place through the self-care menu of the Prepaid Card Calling IVR application, allowing end users to perform more personalized account management.

It works as follows:

- The administrator configures the Prepaid Card Calling IVR application.

- The end user dials the access number and enters the self-care menu.

- By following the IVR prompts, the user associates his or her ANI number with a new prepaid account.

To illustrate: End user John has signed up for PINless dialing service. His mobile phone number 16045558521 (the ANI number) is associated with prepaid card number 72313070131 worth $10.

His account balance drops to $0.02 and is not enough to make further calls. He therefore buys another prepaid card, number 77854126029 worth $20. He dials the access number, enters the self-care menu, and associates his ANI number with 77854126029. Now John’s balance is $20 and he can continue to use the PINless dialing service.

Alternatively, ITSPs can enable end users to delete their existing ANI number and associate this deleted number (or a new number) with a prepaid card. For example, if Jane Doe has associated the ANI number of a temporary location (e.g., a hotel phone number) with her prepaid card, once the number is of no further use to her, she simply deregisters it from her card.

Thus, with this functionality ITSPs can provide their customers with a flexible tool for ANI number management. An additional benefit is that, by making customers abandon depleted accounts, ITSPs receive additional funding from residual account balances.

The description of the Prepaid Card Calling IVR application configuration can be found in the Prepaid calling cards handbook.

Balance announcements

In the table below you can see available variants for balance announcements with the Credit accounts balance announcement option set to backward compatibility or funds/balance value:

|

|

Backward Compatibility |

Funds/Balance |

|---|---|---|

|

Balance = 10; Credit Limit = 300 |

“You have 290 dollars.” |

“You have 290 dollars available.” |

|

Balance = 10; Credit Limit = n/a |

“You have unlimited available funds.” |

“Your balance is 10 dollars.” |

|

Balance = -10; Credit Limit = 300 |

“You have 310 dollars.” |

“Your balance is minus 10 dollars.” |

|

Balance = -10; Credit Limit = 0 |

“You have 10 dollars.” |

“You have 10 dollars available.” |

In the following table you can see available variants for balance announcements with the Credit account balance announcement option set to balance value (with the Announce credit limit option enabled/disabled):

|

|

Balance |

|

|---|---|---|

|

Without Credit Limit Announcement |

With Credit Limit Announcement |

|

|

Balance = 10; Credit Limit = 300 |

“Your balance is 10 dollars.” |

“Your balance is 10 dollars, your credit limit is 300 dollars.” |

|

Balance = 10; Credit Limit = n/a |

“Your balance is 10 dollars.” |

“Your balance is 10 dollars, there is no credit limit.” |

|

Balance = -10; Credit Limit = 300 |

“Your balance is minus 10 dollars.” |

“Your balance is minus 10 dollars, your credit limit is 300 dollars.” |

|

Balance = -10; Credit Limit = 0 |

“Your balance is minus 10 dollars.” |

“Your balance is minus 10 dollars, your credit limit is 0 dollars.” |