Stripe payment processor

The first payment processor that is currently available in PortaBilling via Add-on Mart is Stripe. Stripe is one of the most widely used payment processing systems in the world and supports over 135 currencies. It also supports token-based payments, enables you to accept online payments right away, and allows your customers to set up recurring auto-payments.

Add-on Mart subscribers running MR87 and above can select and use Stripe from within the PortaBilling web interface and receive credit card payments with minimal integration efforts. For MR55–MR86, the integration process with Stripe is also available via a backport patch for the specific MR.

In this integration, Add-on Mart cloud infrastructure (AMCI) communicates with the on-premise PortaSwitch and the Stripe payment processor transfers the payment data via API to the AMCI, which acts as a cloud intermediary.

Let’s see how Stripe payment processor can be integrated into two different scenarios:

Scenario 1. Stripe integration for PortaSwitch MR86 and earlier

Panda Telecom runs MR70 and requires support for online payments using Stripe. Panda Telecom turns to PortaOne to request integration and pays the Add-on Mart subscription fee. The rest of the process is as follows:

-

The PortaOne development team prepares a backport patch for the exact PortaBilling version used by Panda Telecom (for an additional price).

-

The backport patch for Stripe integration is applied within Panda Telecom’s PortaSwitch infrastructure.

-

Panda Telecom’s PortaSwitch authorization credentials for Add-on Mart are set on the Configuration server.

As a result, Stripe appears on the list of payment processors available for Panda Telecom.

Next, Panda Telecom signs a contract with Stripe for a merchant account and receives the Stripe API key. After configuring the Stripe merchant account from within the PortaBilling web interface, Panda Telecom can use Stripe as a payment processor. The whole integration process takes 1-2 weeks.

Scenario 2. Stripe integration for PortaSwitch MR87 and later versions

StarlightNet runs MR87 (or later versions) and wants support for online payments with Stripe. In this case, the process is similar but faster (up to 1 week), as there is no need for a backport patch:

-

StarlightNet turns to PortaOne to request integration and pay the Add-on Mart subscription fee.

-

StarlightNet’s PortaSwitch authorization credentials for Add-on Mart are set on the Configuration server.

As a result, Stripe now appears on the list of payment processors available for StarlightNet. Next, StarlightNet signs a contract with Stripe for a merchant account and receives the Stripe API key. After configuring the Stripe merchant account within the PortaBilling web interface, StarlightNet can use Stripe as a payment processor.

If you would like to add any other payment processors besides Stripe, this can also be done with the help of Add-on Mart. Such new integrations take up to several weeks and do not require an update.

For the full list of currently available payment processors that support token-based payments in PortaBilling, refer to Supported online payment processors section.

Configuration

The initial configuration for enabling Stripe is done via the Configurator by PortaOne admins after you subscribe to Add-on Mart.

Next, you need to create a merchant account with Stripe (might take a while until you get verified) and get your API key. Using this API key, you can configure Stripe as a payment processor within PortaBilling using the step-by-step instruction in the Configuring Stripe payment processor handbook.

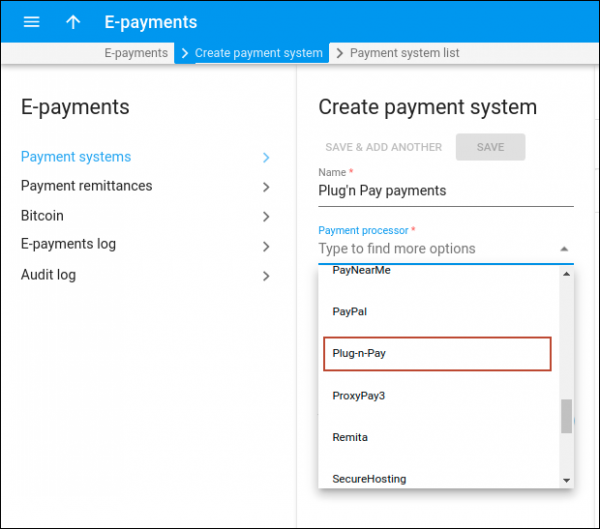

Plug'n Pay payment processor

Service providers can accept online payments via Plug’n Pay payment processor that is available in PortaBilling via Add-on Mart. Even service providers with older PortaSwitch versions, e.g., MR75 can start using Plug’n Pay without a full system update.

To start using Plug’n Pay, service providers need to subscribe to Add-on Mart and have an existing active Plug’n Pay merchant account. Starting with MR91, or in MR90-1, the Plug’n Pay payment processor is immediately available and can be activated within a few days. For service providers using the older release of PortaSwitch, i.e., MR55–MR90, the PortaOne team can make a backport patch for the specific MR to enable using Plug’n Pay. In this case, the entire integration process might take 1-2 weeks.

As a result, Plug’n Pay appears on the list of available payment processors on the PortaBilling web interface and can be used just like any other payment processor.

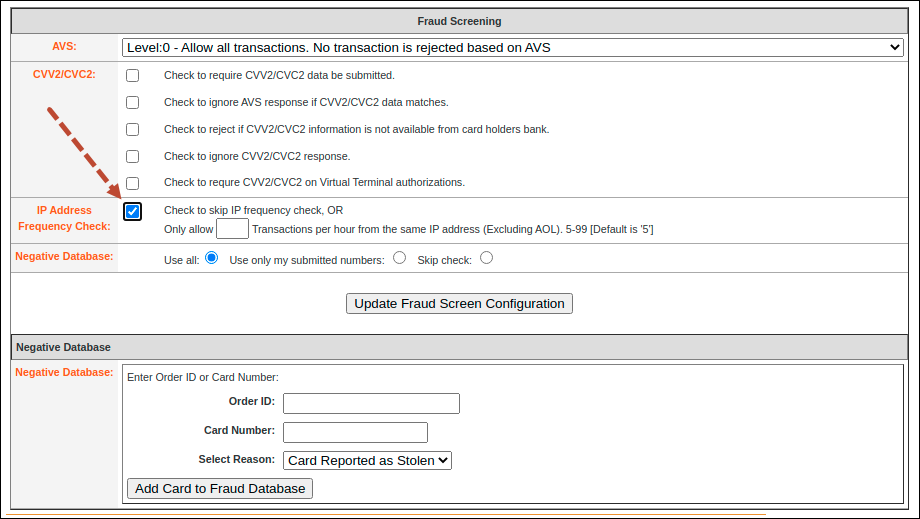

Optionally, to prevent fraud, you may want to enable the Card number frequency check. It allows specifying the maximum number of transactions from the same card number within a particular time period. Please contact Plug’n Pay for more details.

Benefit

Due to the Add-on Mart cloud-based integration with Plug’n Pay, service providers can get virtually instant access to online payments via this payment processor, even if they are running an older version of PortaSwitch.

Strong Customer Authentication support for online payments

To prevent fraudulent transactions and make online payments more secure, new Strong Customer Authentication (SCA) requirements have been introduced in Europe as a part of the second Payment Services Directive (PSD2). Service providers in the European Economic Area (EEA), UK, and Switzerland must meet SCA (also known as two-factor authentication, 2FA) requirements. Without SCA, the customers’ banks may decline the payments.

SCA is implemented with 3D Secure authentication. Applying 3D Secure adds an extra step after the checkout, where the customer has to provide additional information to complete the payment (e.g., to enter a one-time password received on their phone).

For example, the service provider uses Stripe payment processor to receive online payments. Mary Smith, their customer, lives in the UK and, therefore, she has to pass SCA.

Let’s say Mary Smith wants to pay her invoice via the self-care interface. She fills in her card details and initiates payment. Meanwhile, Stripe sends a transaction request to Mary’s bank. The bank sends a one-time password to Mary’s phone. Mary is redirected to the bank page, where she enters a one-time password to authenticate a payment. After the confirmation, Mary is redirected back to the PortaBilling self-care interface. Once the payment is successful, Mary’s balance changes in PortaBilling.

Note that the customer’s bank may decline the auto-payments because there is no customer to pass SCA. If the auto-payment is declined, the next auto-payments are automatically disabled. The customer receives an email notification informing that the payment has failed because it requires an additional verification step. They can make a manual payment from their self-care interface.

Currently, Stripe payment processor is supported by SCA. Support for other payment processors operating in the EEA will be implemented in future releases. SCA with Stripe is immediately available to you in MR91, MR90-1 via Add-on Mart. If you’re using Stripe on the older release of PortaSwitch, i.e., MR55–MR90, the PortaOne team can make a backport patch for the specific MR to enable SCA for Stripe. Contact us to find out more.

Benefits

- Service providers meet SCA requirements and can continue accepting online payments in the EEA, UK, and Switzerland.

- End users gain an additional security layer for their online payments due to 2FA.