If a payment exceeds the total amount due of all unpaid invoices, the excess amount will be assigned to the special customer property “unallocated payments”.

Unallocated payments indicate that the customer has "overpaid" at some point in the past, which will automatically be applied to settle future regular or out-of-turn invoices, therefore, affecting their payment status. Note that the total amount of unallocated payments may change, for example, it may increase or decrease. However, unlike the customer’s balance, unallocated payments cannot become negative.

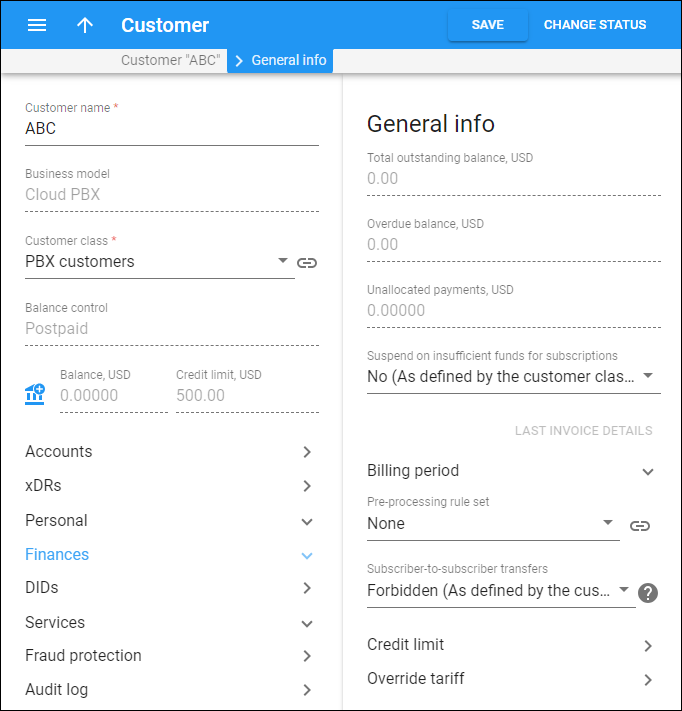

You can see the customer’s current “unallocated payment” status, open the customer record > Finances > General info > Unallocated payments.

Let’s say the customer plans to be away for several months starting at the end of September and is concerned about paying their bills on time. Then in mid-September with no outstanding invoices, they make a $30 payment.

This amount, in the absence of any outstanding invoices, is assigned to “unallocated payments.” Suppose the service charge for September is $20. When the invoice for September is generated on October 1st, the unallocated payment of $30 is applied to it, immediately changing the invoice's status to “Paid”. The remaining unallocated payments balance is now $10 ($30 initial payment minus $20 September invoice).

Understanding unallocated payments

The total amount of unallocated payments can increase or decrease depending on the actions:

- Increase – occurs each time a customer makes a payment exceeding the total amount due of all unpaid invoices, or when a paid invoice is voided.

- Decrease – occurs when a customer has unallocated payments and they are used to settle either regular or out-of-turn invoices. For instance, if a $5 invoice is generated for a customer with $15 in unallocated payments, this invoice is covered using those payments, while the remaining amount of unallocated payments is then reduced to $10.

Let’s see how different transaction types such as manual credit or refund, affect a customer’s unallocated payments.

- Refund – the total amount of unallocated payments can decrease when an admin applies a refund to the balance of the customer who has unallocated payments.

Example

Say a customer orders two batches of phones from their service provider. They pay $100 to cover the invoice for the first batch of 10 phones and also make an advance payment of $100 for the next batch of 10 phones.The advance payment is recorded as $100 in unallocated payments on the customer's account. The customer realizes that the second order was a duplicate and cancels it. The admin makes a refund of $100 to the customer.

This refunded amount is deducted from the customer's unallocated payments, leaving a zero balance in unallocated payments.

If a customer has no unallocated payments, a refund transaction will only affect the customer’s balance and change the status of a previously paid invoice to “Unpaid” or “Partially paid.” For more details on this type of balance adjustment, refer to the Balance adjustment chapter.

- Credit – if the admin applies a manual credit or a promotional credit to the balance of the customer with unallocated payments, this action does not change the customer's unallocated payments amount.

Example

Say a postpaid customer has $15 of unallocated payments at the beginning of March after a prior overpayment. During March, they experience internet service disruptions due to technical issues on the service provider's end. Acknowledging the inconvenience caused and aiming to maintain good relations with the customer, the service provider offers them a $10 credit. This credit is meant to compensate for a portion of the subscription fee.

Once the admin applies the manual credit, it reduces the customer's balance by $10. However, their unallocated payments remain unchanged at $15. Consequently, when the March invoice is generated, it shows a $50 subscription fee, the $10 credit, and the $15 unallocated payments, resulting in a $25 outstanding balance.