The distributor model is designed to expand sales activities by engaging additional agents and enlarging the point-of-sale network, without any significant costs or risks.

Customers can purchase new products, settle their invoices or refill their prepaid accounts by paying cash to a distributor (for example, the owner of the grocery shop opposite your house could be a distributor). After the distributor collects the money, he delivers it to the ITSP, minus his commission. PortaBilling automatically calculates the commission and checks the distributor’s balance to keep track of how much he owes the ITSP, and also to verify the distributor’s credit limit. This helps to avoid a situation where the distributor would activate too many accounts without first submitting payment for accounts already activated, and thus limits the ITSP’s risk of loss in case the distributor goes out of business.

A distributor need not have any special technical knowledge or skills. They either deliver to the end user a tangible product (e.g., SIM card, calling card) supplied to them beforehand in bulk, or, in the case of an intangible product (e.g., registering a customer’s cell phone number so they can make PINless dial calls), they can create accounts/customers using a quick form. All account management operations are done via the web interface.

While a distributor might only sell a few new accounts each day, creating accounts in such small amounts at the distributor’s request requires too much administrative overhead. Also, when prepaid cards or top-up vouchers are being printed in the print shop, it makes sense to do this for many thousands of cards at once.

Therefore, the account generator can be used to produce a large batch of accounts so that all the cards can be printed at once. Then later a distributor can be assigned to some of these accounts (i.e. when this distributor receives a portion of cards to sell).

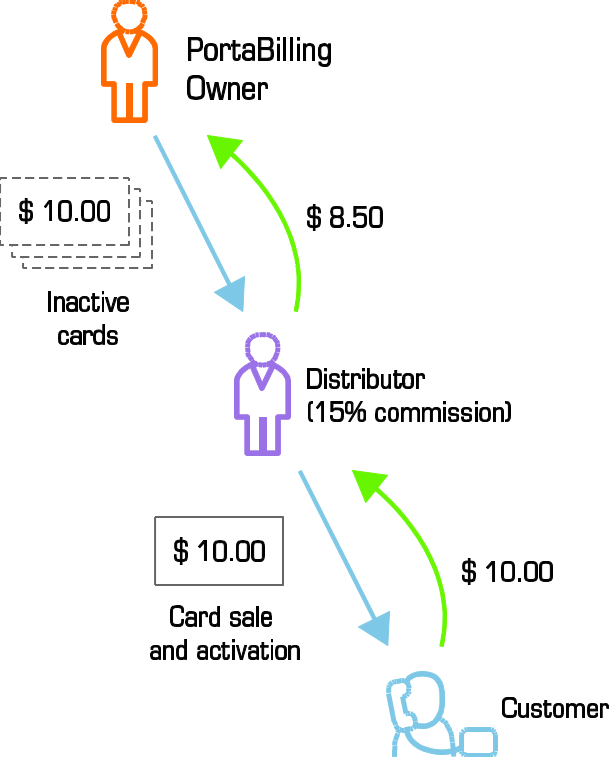

Nonetheless, when some of a batch of cards is delivered to a distributor their total face value could be quite large. So it is risky to allow all of the cards to be active (e.g., if the cards are stolen, they could all be used). Thus cards (accounts) are typically generated and supplied to the distributor in an inactive state, and only when the distributor activates the card (account) it can be used to access the service. Likewise, the distributor is only charged once activation is complete.

The following are associated with a distributor:

- Default Sales Commission (applied when an account is activated or a distributor is assigned to an active account);

- Default Payment Commission (applied when a payment is entered by a distributor).

When a customer or an account is activated or created using a quick form under a distributor, the latter’s balance increases by the account’s balance, minus the distributor’s commission. For example, if the distributor’s commission percentage is 15% (the default sales commission) and he sells a new account with a balance of $10, the distributor is charged $8.50 (this is the amount they owe to the CSP). So the distributor receives $10 from the customer and gives back $8.50 to the CSP, thus making a profit of $1.50.

If the distributor applies payment of $10 towards an account, and his payment commission percentage is 10% (the default payment commission), he is charged $9 and receives a $1 profit.

Thus the distributor is charged when:

- they apply payment towards a customer or an account;

- they are assigned to an active account;

- an account to which the distributor is assigned has been activated, or a new account is created in the active state.

To prevent operator error when attempting to generate accounts being assigned to a specific distributor, the account generator will only allow the creation of inactive debit accounts/vouchers, and these accounts will have to be activated later.

Typically used for: Point-of-sale agents, where an agent delivers the product to end users, collects payments, and then delivers the money (minus his commission) to the service provider.

Multi-level distributors

Two distributor models are supported: the “simple” and the multi-level. The multi-level distributor model allows CSPs to further expand their sales activities and the size of their distribution network to increase their customer base and total revenue.

In the multi-level model, distributors are able to create their own subdistributors with whom they share the part of their commissions. The amount of a subdistributor’s commission cannot be higher than the one the service provider defines for the distributor.

While distributors operate with end users and with subdistributors, subdistributors operate with end users only.

Before a transaction takes place between an end user and a subdistributor, the system checks whether the parties’ balances are sufficient to cover the transaction. This ensures that credits and balances are controlled efficiently within this segment of the distribution chain.

The following example of commission-sharing by a distributor and the distributor’s subdistributor illustrates how this functionality works.

An administrator creates Distributor X, assigning the default distributor payment commission of 20%. Distributor X logs into the distributor self-care interface to create Subdistributor Y, assigning the default subdistributor payment commission of 10%.

Subdistributor Y logs onto the subdistributor self-care interface to create retail customers. The subdistributor then receives a $10 cash payment from a retail customer and registers a manual payment of $10 on the customer’s behalf to the service provider of record (either the distributor or the CSP). As a result, the balances of the parties involved change as follows:

- The customer’s balance is topped-up for a $10 to be spent on services.

- Subdistributor Y owes the Distributor X $9 (customer payment amount less the subdistributor commission: $10 – ($10 * 10%) = $9).

- Distributor X owes the service provider $8 (customer payment amount less the distributor commission: $10 – ($10 * 20%) = $8).

In this way, multi-level distribution allows CSPs to build a branched distribution network and thereby increase total revenue.

Payment recording by a distributor

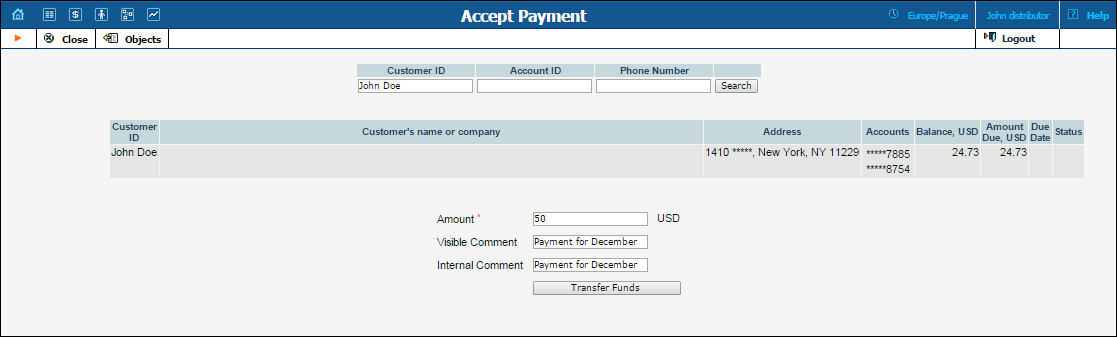

Apart from creating customers and/or activating accounts, distributors’ functions also lie in recording payments made by end users to top up their balance. When end users do not have the means to make payments online (e.g., they have no credit card), they can make cash payments via distributors. Distributors record such payments to PortaBilling.

Distributors can record payments for any “direct” customer (i.e. a customer who does not belong to any reseller). However, to prevent distributors from acquiring customer information and misusing it, they can only search for customers and accounts if they enter either a full customer/account ID or a full phone number. Then they will only see limited information about a customer or an account.

When a payment has been accepted and recorded to PortaBilling, a distributor is charged the payment sum minus his commission (e.g. the distributor applies a $10 payment towards an account, and with his 10% commission, the distributor is charged $9 and earns $1 in profit).

This rule applies both to the customers this distributor is assigned to and to any other direct customers of an CSP.

Distributor xDR history

Distributors can view only their own xDR history, which consists of the transactions they made. Thereby CSPs prevent distributors from acquiring customer and account information and misusing it.

Distributors can reverse only payment transactions, e.g., if they have entered the wrong sum when recording the customer’s payment. The xDRs produced for account activation are not reversible.

Distributor commission report

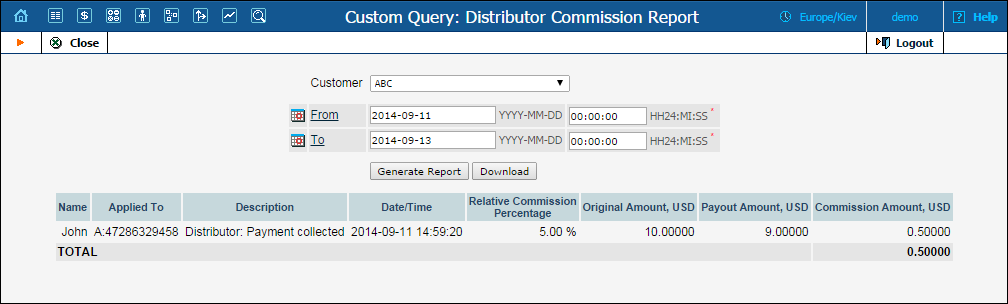

For each transaction performed by a distributor, an xDR is created and the commission is calculated. However, showing the distributor’s actual profit could be more advantageous.

Distributors have the ability to track the profits they gain from sales and payment collections and the relative commission percentage and commission amount are provided in the form of a report.

To allow downloading commission reports for distributors, set the Distributor_Commission_Report value in the CustomXDRReport.EnabledPlugins option on the Configuration web server interface.

The administrator creates the ABC distributor with a 20% commission. The ABC distributor creates the John subdistributor with a 10% commission.

The John subdistributor makes a manual payment of $10 for the retail customer.

The John subdistributor launches the commission report where the commission percentage (10%), the original amount of funds ($10), payout amount of funds ($9), and commission amount ($1) are declared.

The commission report for the ABC distributor reflects the operation performed by the John subdistributor with the ABC distributor’s commission applied: the commission percentage 10%, the original amount of funds $10, payout amount of funds $8 (i.e. $10 – 10% – 10%) and the $1 commission amount.

Thus, using commission report tools, distributors have a clear idea of the profits received from performing business operations.

The CSPs are able to receive general information about all the distributors or only for a particular one.