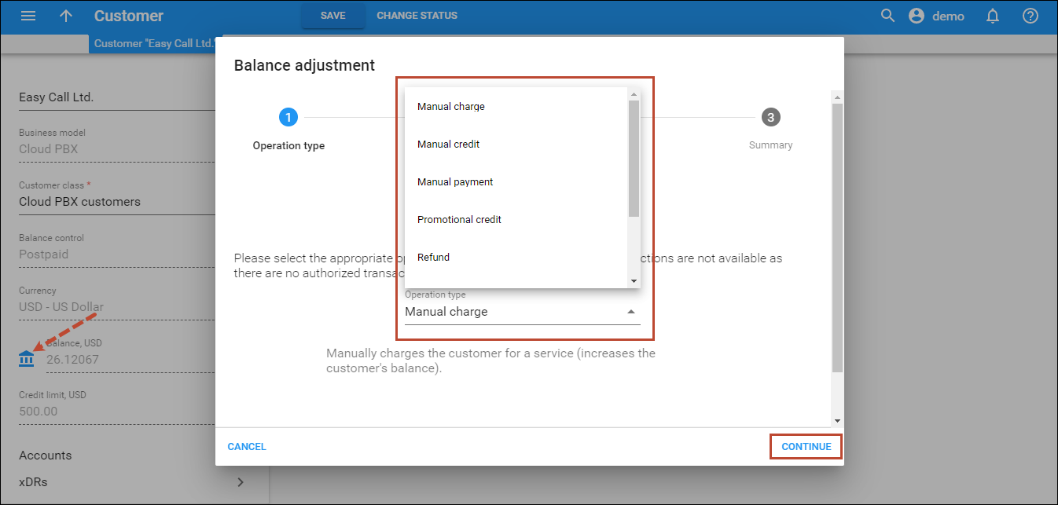

Sometimes the administrator needs to intervene in the billing process and amend charges automatically produced by the system (xDRs for voice calls or Internet sessions, subscription charges, etc.). PortaBilling offers a set of transactions for adjusting a customer’s bill.

The currently available set of balance transaction types includes:

| Transaction Type | Description | Effect on postpaid customer’s balance | Effect on prepaid customer’s available funds |

|---|---|---|---|

| Manual Charge | Use this transaction to manually charge a customer for a specific service they used. | Increase | Decrease |

| Manual Credit | Use this transaction to manually give compensation related to a specific service. | Decrease | Increase |

| Promotional Credit | Use this transaction to give the customer credit, for example, as a sales promotion. The difference between this and “Manual Credit” is that this transaction applies to a special “Credits/Promotions” service, and not to any actual service. Basically, it provides some “virtual” funds to the customer for future use. | Decrease | Increase |

| Manual Payment | Use this transaction when receiving payment (e.g., cash or check) directly from the customer. | Decrease | Increase |

| Refund | Use this transaction to refund an earlier payment received from the customer (e.g., a check returned by the bank). | Increase | Decrease |

| E-Commerce Payment | Use this transaction to charge the customer’s credit card and apply the amount to the customer’s balance as payment. | Decrease | Increase |

| E-Commerce Refund | Use this transaction to reverse a previous E-commerce payment. It withdraws funds from your company’s merchant account and applies them as credit to the customer’s credit card. The amount is added to the customer’s balance. | Increase | Decrease |

| Authorization Only | Verifies that the customer’s credit card is valid and reserves a given amount. Returns a transaction ID to be used in a Capture Payment transaction. Does not affect the customer’s balance in PortaBilling or his credit card balance. | N/A | N/A |

| Capture Payment | Charges the customer’s credit card and applies the amount to his balance as a payment (decreases the customer’s balance). Requires a transaction ID from the Authorization Only transaction. The amount must be less than or equal to the amount of the corresponding Authorization Only transaction. | Decrease | Increase |

| Void | This option is available if the Authorization Only transaction has been made and has not yet expired. Use it to cancel the Authorization Only transaction and release the blocked amount. Requires a transaction ID from the Authorization Only transaction. Doesn’t affect the customer’s balance. | N/A | N/A |

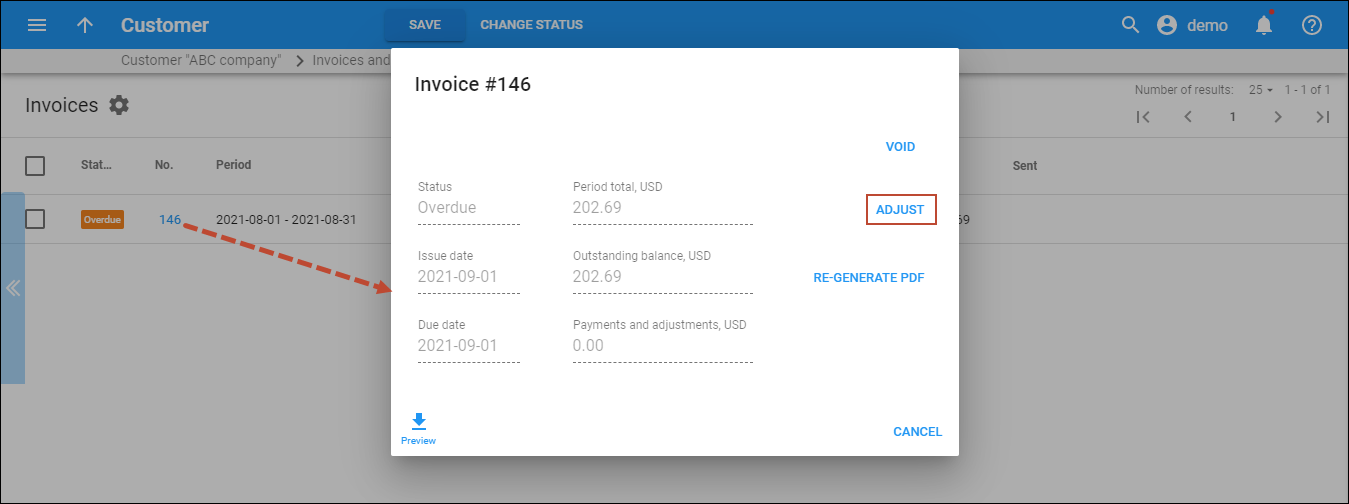

Outstanding balance adjustment

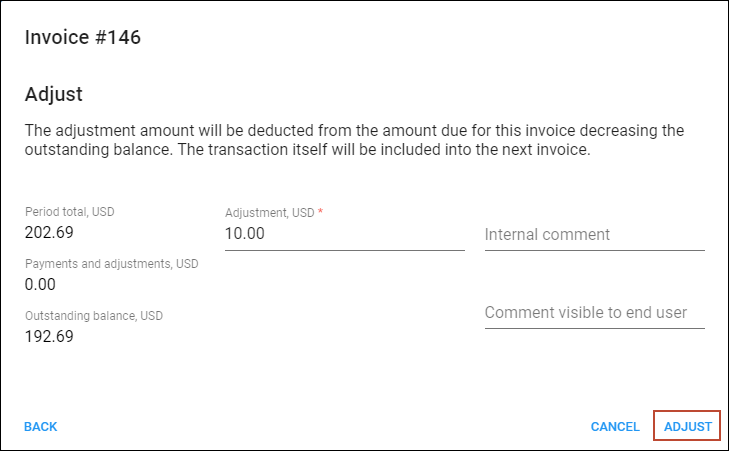

Sometimes service providers may need to adjust an invoice amount and leave it unchanged (for example, when a customer disputes an invoice and asks for a waiver although the invoice data has already been included in company reports).

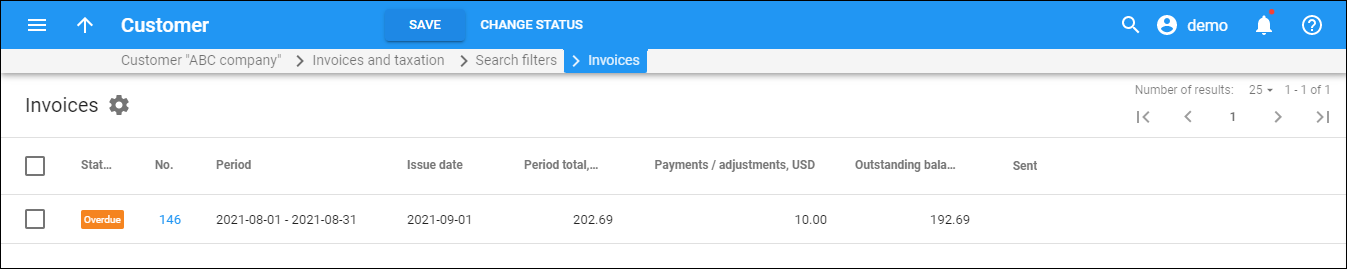

Outstanding balance adjustment functionality does just that. Administrators can reduce the amount a customer must pay for an invoice without regenerating the invoice. To do this, the administrator just enters the waived amount for the invoice. The customer pays only the balance to cover the invoice in full.

The adjustment operation does not change any invoice data (or what’s on the .pdf file). If an adjustment is made to an invoice issued several billing periods ago, all subsequent invoices are also left unchanged. The adjustment transaction(s) is only reflected in the invoice for the current billing period.

Consider the following example. A customer’s billing period is monthly. On March 1st, an invoice for February for $1000 is generated and on April 1st, a March invoice for $500 is generated. Later in April, the customer disputes some of the charges from his February invoice and is given a waiver for $50. The administrator enters the waived amount and therefore the customer pays $1450. Now his February and March invoices are paid.

These transactions will be reflected in his April invoice:

- Previous Balance – $1500.

- Invoice Adjustment – $50.

- Payment – $1450.

With outstanding balance adjustment functionality, ITSPs easily deal with invoices requiring offsets. Additionally, the workload for the accounting department is reduced since activities related to invoice regeneration (i.e., resending invoices, etc.) do not have to be performed.

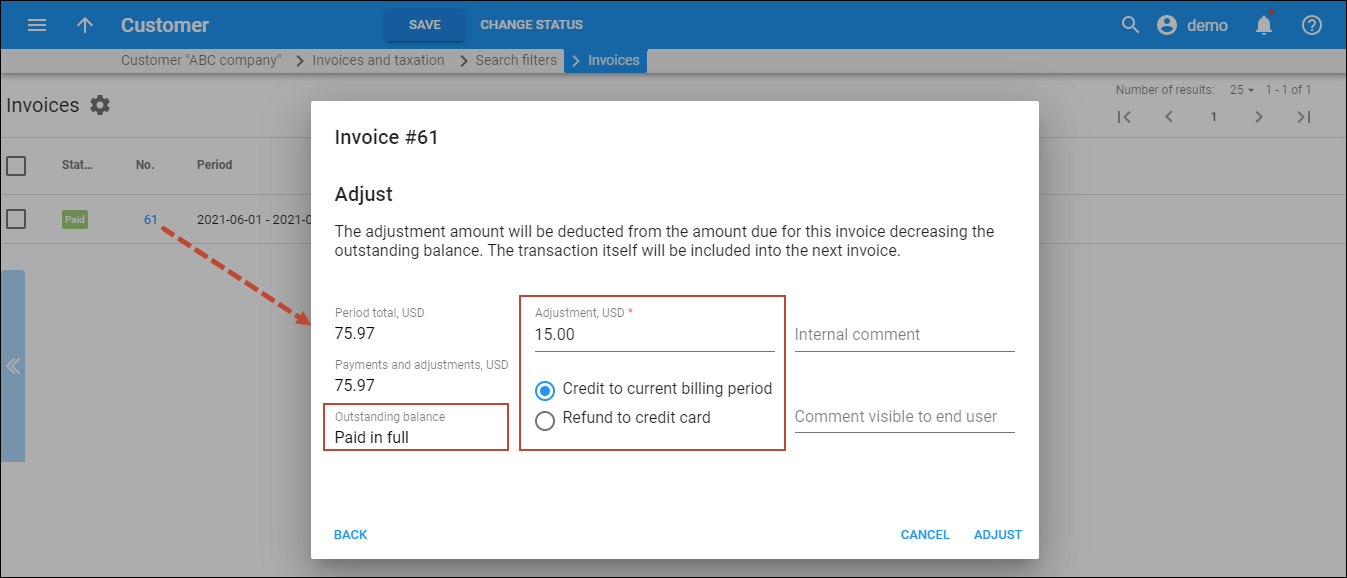

Adjustment for paid invoices

Administrators can also adjust invoices with a Paid status that have already been paid by customers (e.g., automatically by credit card). In this case, the adjustment transaction is a refund that is applied to the customer’s balance.

When adjusting a paid invoice, an administrator can select how to apply a refund to the customer: either to the customer’s balance as an unallocated fund or to their credit card, if that has been configured for the customer.

A refund that is issued for a customer’s current billing period appears as an unallocated payment and is included in their forthcoming invoice.

If a refund to a credit card is unsuccessful for some reason, the refund is added to the customer’s unallocated payments and is used for paying their following invoice.

This capability to adjust paid invoices improves the claims settlement process, thus increasing the customer’s overall experience.