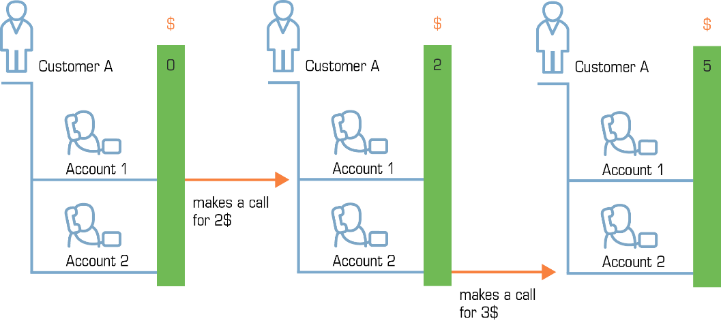

A customer is an entity (an individual or a company) who is responsible for using the service via one or more accounts. For instance, when a family signs up for residential VoIP services, a man, his wife, and his brother will all have individual phone lines, each represented by an account. The person who signs the contract (and who is responsible for paying the bills) will be entered as the customer, and all the accounts will be listed under him.

When a credit account is charged for using the service, this directly affects the customer’s balance, and the activities of all accounts are included in the consolidated invoice. This allows quick tracking of service use for a group of accounts, or the application of a credit limit for the whole group.

Typically used for: business end-customers (when more than one account per customer is required)

Customer balance model

Customers are divided into prepaid and postpaid categories, depending on how their balance is controlled.

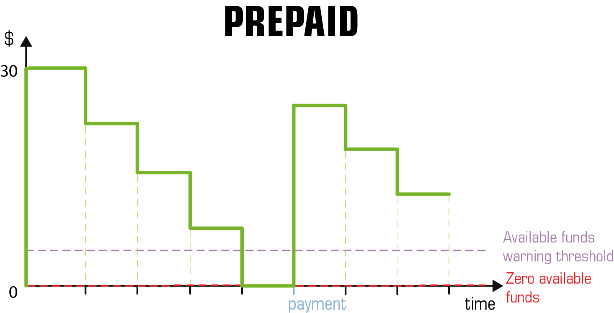

Prepaid customers

For customers who have a prepaid balance model, they first pay for the services and then use them (e.g., customers will not be able to make outgoing calls or surf the Internet without topping up the balance first).

The balance for prepaid customers is shown as a positive value and indicates how much of the services can be used with the funds currently available.

While consuming the service, the amount of funds decreases. When it reaches zero value, no more services can be used.

Once payment is made, the amount of available funds increases.

Typically used for: calling card services.

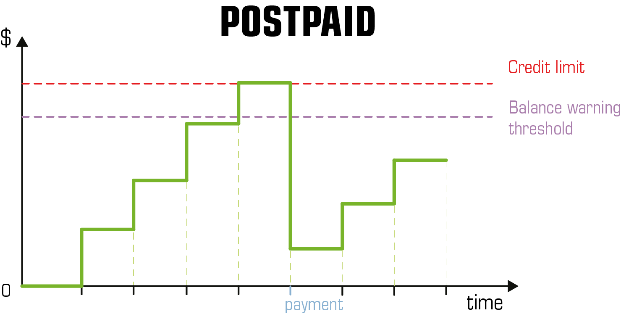

Postpaid customers

For customers who have a postpaid balance model, services are provided to them on credit. This means they use the services and then pay for them on the basis of invoices generated at the end of a billing period.

The balance for postpaid customers indicates the amount of money owed to the service provider. Once the invoice is paid, the balance decreases.

To prevent misuse of services and fraud traffic (e.g., the account’s credentials were stolen and lots of traffic was sent to the network), it is highly recommended that you set up a credit limit for postpaid customers. When the customer’s balance reaches that credit limit, this customer’s accounts will no longer be allowed to use the service.

Typically used for: businesses (e.g., companies having several phone lines and paying consolidated invoices for the total amount of services used).

Please find the usage of customer balance models different business scenarios in the table below:

|

Description |

Customer balance model |

Account type |

Business scenario examples |

|---|---|---|---|

|

The customer receives and pays consolidated bills for services used by all customers’ users. The customer balance and credit limit are shared among all users under that customer. |

Postpaid |

Credit subordinate * |

Cloud PBX, messaging service, triple-play service provisioning for residential customers |

|

The customer prepays for service usage and doesn’t receive bills (though can receive statements). The customer’s available funds are shared among all users under that customer. |

Prepaid |

Credit subordinate * |

Residential VoIP, messaging service, wholesale termination, IPTV and Internet access provisioning |

|

One customer can have multiple individual users. Each user prepays for their service usage. No bills or statements are issued. One PIN/phone line with individual balance per user. |

Any (doesn’t matter for debit accounts) |

Debit |

Prepaid calling cards, PINless dialing, callback, Hotspot and Viber-like services. Also, can be used for social networks users |

* It is possible to define individual credit limits for particular users under the customer (in this case users top up their accounts themselves with a credit card, either manually or automatically.) This account’s service usage affects both the account’s balance and the customer’s balance or available funds.

Organizing the customer hierarchy, administrators can easily configure the distributed infrastructure of a company with several functional departments (for example, the support and sales departments) so that their billing-related activities are maintained separately. Moreover, features such as extensions and huntgroups have only to be configured once before they can be shared among all of a company’s departments.

This is achieved by introducing two types of customers within a hierarchy:

- Main Office (HQ) – this defines the “main” customer in the group for which the basic service configuration is done. All extensions and huntgroups added for this customer become available for all of its linked customers.

- Branch Office (site) – his defines the “subordinate” customer created under the Main Office (HQ) customer. This customer inherits all of the main customer’s extensions and huntgroups.

Customer hierarchy is also useful for when an administrator needs to configure a company’s geographically-distributed infrastructure. In this case, the company has multiple independent offices and requires individual billing statistics for each of them.

Consider the following, for example. The company has its main office on shore and its petroleum towers at sea. The personnel who work on the towers need to communicate with the main office via extensions and they also make calls to the main office’s huntgroups. Their chief accountant wants each tower’s billing and payments activities managed individually.

The administrator creates a Main Office (HQ) customer in PortaBilling and configures the extensions and huntgroups for it. Then he creates a group of Branch Office (site) customers and links them to the Main Office (HQ) customer created earlier. Since the extensions and huntgroups defined for the Main Office (HQ) customer are available for this group of linked customers, no additional configuration is required.

The administrator then configures the billing-related activities (such as invoice generation, balance management, amount due tracking) for each customer he created, and billing-related statistics for each of them can be tracked individually.

Consolidated invoice for customer hierarchy

Let’s say a company has a main office and a group of branch offices. All of the offices share the same PBX environment (e.g., personnel can communicate across all of the offices via extensions, or make calls to other offices’ huntgroups). The company owner wants to pay the communication charges for all their offices in a single bill.

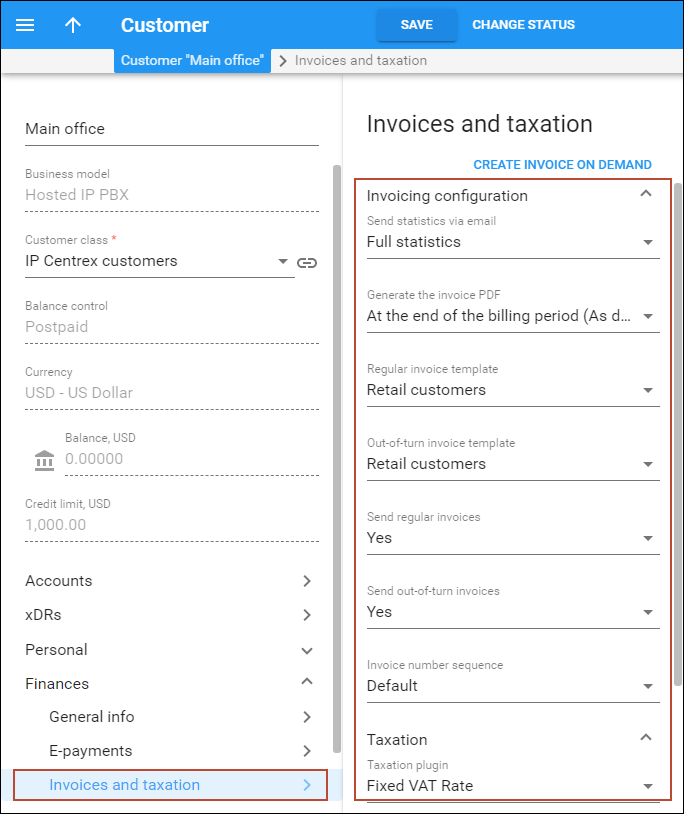

An administrator creates a Main Office (HQ) customer and a group of Branch Office (site) customers and links them together. Then the administrator enables both statistics and invoice generation and defines the taxation settings for the Main Office (HQ) customer. The billing period must be the same for all linked customers in the group.

To avoid discrepancies during tax calculation, disable tax calculation for all Branch Office (site) customers within the group.

At the end of the billing period, the system generates a consolidated invoice for the Main Office (HQ) customer. This invoice includes the total charged amount for all of the company offices. The Main Office (HQ) customer also receives statistics reports generated for each branch office.

To generate statistics reports for Branch Office (site) customers and send them to the Main Office (HQ) customer, the administrator must perform the following:

- Enable the Send_Stats_If_No_Invoice option on the Configuration server.

- Enable statistics generation for all Branch Office (site) customers in the group.

- Set up the Main Office (HQ) customer’s email as the main contact for all Branch Office (site) customers in the group.

The system generates consolidated invoices in accordance with the time zone defined for the Main Office (HQ) customer. If Branch Office (site) customers are located in different time zones, you may need to postpone invoice generation until their billing periods are closed. In that case, use the customer class option The billing period is closed.

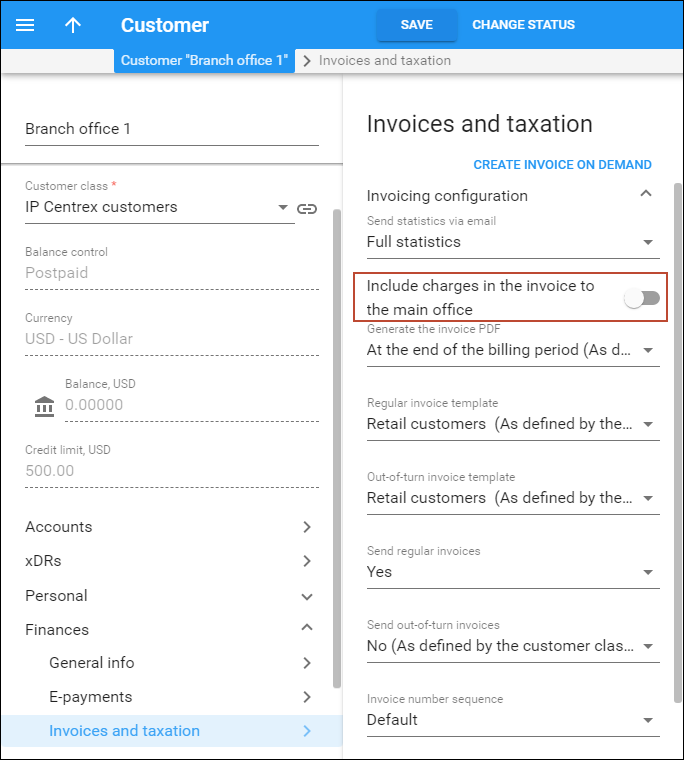

To generate an individual invoice for a branch office, the administrator disables the Include charges into main office invoice option for the corresponding Branch Office (site) customer.

Important notes

- The administrator can configure an individual credit limit/spending plan for each linked customer in the group.

- If the Main Office (HQ) customer is blocked, suspended or has exceeded its individual credit limit, Branch Office (site) customers may continue using the services unless their individual credit limits/spending plans have been reached. At the end of the billing period, a consolidated invoice is generated.

- If the Main Office (HQ) customer has been provisionally terminated, Branch Office (site) customers may continue using the services unless their individual credit limits/spending plans have been reached. At the end of the billing period, a consolidated invoice is not generated and the Branch Office (site) customers’ charges are not moved to the Main Office (HQ) customer’s balance.

- If the Main Office (HQ) customer is exported or permanently terminated, Branch Office (site) customers are exported or permanently terminated as well. At the end of the billing period, a consolidated invoice is not generated and the Branch Office (site) customers’ charges are not moved to the Main Office (HQ) customer’s balance.

This allows service providers to consolidate all of their communication charges on a single bill for their customers that have distributed infrastructure, and thereby provides greater convenience.

Customer termination

You may terminate a customer, including all his accounts. If, for some reason, you do not want a customer to remain in your PortaBilling environment any longer, click the Change Status button on the Customer Info toolbar and then select the Permanently Terminated check box. This option allows you to stop all the customer’s activities, and later to remove him and all his accounts from the environment. When terminated, the customer is no longer available for any operations. The only way to trace this customer is by using Advanced Search with the “Permanently Terminated” status filter.

Provisional customer termination

In addition to permanent termination, you can use the provisional termination functionality.

Once a customer is provisionally terminated, all their services are closed (that is, no services can be used). But there is still an option to reactivate services that were disconnected if the customer should change their mind later on. The administrator is easily able to restore this customer’s services so that they can be used exactly as before.

If a customer ultimately decides to discontinue services, the administrator can permanently terminate this customer in the system. In case of permanent termination, all customers’ services are closed and cannot be restored.

Note that if you are going to provisionally terminate a customer, this customer won’t be charged for any DID numbers assigned to them. At the same time, the DID provider will still charge you a fee (e.g., $5/month) because these DID numbers remain allocated to your network until the customer is permanently terminated.

Also, a subscription fee won’t apply for the days when a customer is provisionally terminated (credits for a subscription fee are issued for these days), no matter what conditions are set for subscription charging.

Customer classes allow you to define which type of service a customer is using and a set of parameters that will be shared among a certain category of customers. For instance, suppose your invoice term for retail customers is “Net 21 days,” while for business customers it is “Net 30 days.” If your operators enter these values manually for each customer, there will inevitably be mistakes. Instead, you can define two separate customer classes, one named “Retail” and the other “Business,” and define these parameters within them. After that, your operators need only assign a specific class to a given customer in order for the customer to automatically inherit all the class properties (grace period, invoice template, taxation, notification list and so on).

Balance control for customers billed externally

Service providers can maintain an actual balance for postpaid customers billed via external systems (i.e. when invoices are issued and processed via an external system).

This allows service providers to protect customers from fraud and unauthorized expenses by utilizing the credit limit tool. This tool restricts the amount of money that a customer can spend on services per billing period and suspends customer services when the credit limit is reached.

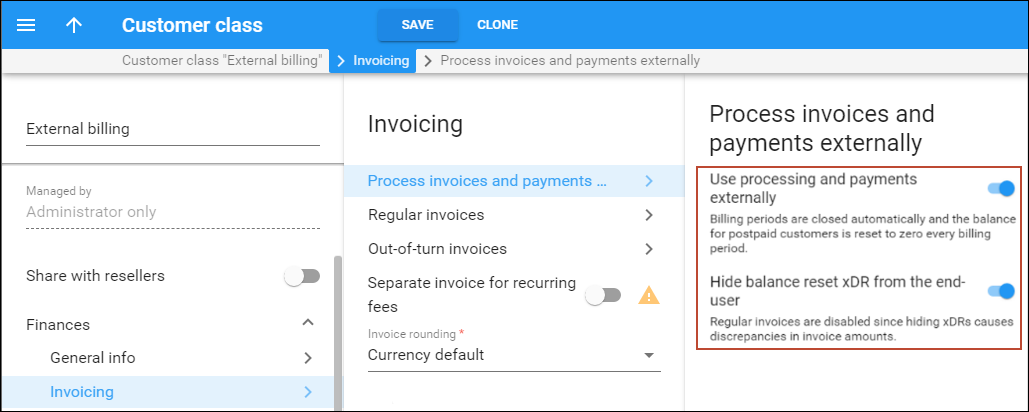

The administrator configures the following options for a customer class:

- Use processing and payments externally – this marks customers assigned with this customer class as being billed via an external system. Billing periods are closed automatically and the balance for postpaid customers is reset to zero by applying the manual credit transaction at the end of the billing period.

- Hide balance reset xDR from end-user – this defines whether or not to hide the reset balance transaction on the customer self-care interface. If this option is enabled, the regular invoices are disabled since hiding xDRs causes

discrepancies in invoice amounts.

The administrator assigns this customer class to customers who are billed via an external system. At the end of the billing period, their balance is automatically reset to zero.

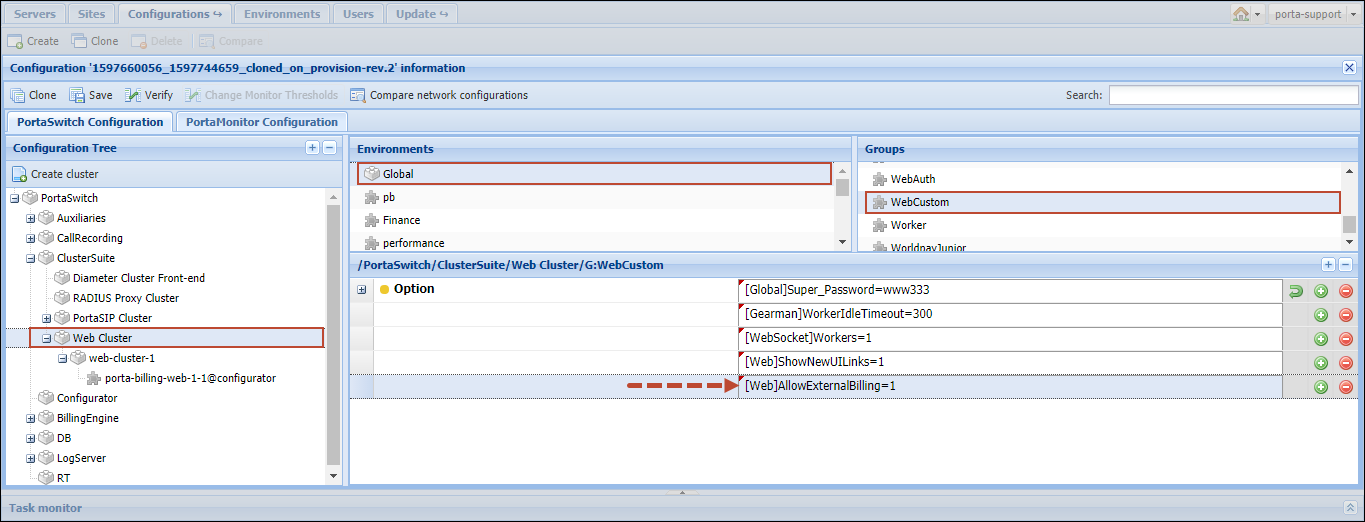

To enable this functionality, the administrator adds the [Web]AllowExternalBilling=1 option for the WebCustom group on the Configuration server.

This allows service providers to use the credit limit tool for those of their customers who are billed via external systems, thereby protecting them from fraud and/or unauthorized expenses.