This service allows your customers to transfer funds from their accounts in PortaSwitch to a mobile phone’s balance in another country. This service is very popular in expat communities, since people who regularly use a VoIP service to call their families back home can also top up the balance on their relative’s cell phone.

What is a remittance processor?

A remittance processor (such as TransferTo) is a transaction processing system that delivers international top-up services. You create an account with an online remittance processor, provide it with your company information and establish the method of transferring funds from you to it on a periodic basis. In return, you receive credentials (username, password, etc.) for initiating transactions via the remittance API. Now your application can connect to the API server and, upon providing valid authentication information, request that funds be transferred to a customer of a mobile carrier. The system functions in the following way:

- Customer A subscribes to VoIP services provided by company X using the PortaSwitch platform. A adds funds to his account in PortaSwitch (cash payment, credit card, voucher, etc.).

- A wants to send funds to the mobile phone of his relative, B.

- A uses PortaSwitch (via web interface, IVR or SMS) to initiate a mobile remittance transaction. Funds are withdrawn from his account in PortaSwitch and the remittance processor Y is instructed to transfer the funds to B’s mobile phone.

- Y contacts the mobile carrier that owns the network that B’s mobile phone is connected to, and instructs that funds be added to B’s account.

- Later (on a periodic basis), service provider X transfers funds to the remittance processor to cover the total of all such transactions in the period.

Relationship between transferred and debited amounts

By the nature of international mobile balance transfers, the recipient of the payment will receive the funds in a currency different from the one used by the “donor.” Hence the question of exchange rates arises. The service provider naturally wants to ensure that:

- The amount that is withdrawn from the donor’s account is no less than the actual cost (the amount that the service provider will have to pay to the remittance processor to cover the funds actually delivered to the recipient, given the exchange rate and fees applied by the remittance processor).

- The amount that is withdrawn from the donor’s account incorporates a profit margin for you as the service provider.For example, when a transfer of 50 Australian dollars is made, if the amount payable to the remittance processor (given the AUD:USD exchange rate and the remittance processor’s transaction fee) is 52.369 US dollars, then the amount debited from the donor’s account will be $53.37, since it includes your profit of US $1.00.

- The amount that is withdrawn from the donor’s account is represented by a number that is easy for the end user to understand. Payment remittance cannot perform top-ups with an arbitrary amount (e.g., you cannot request that an amount like 0.05 AUD or 9.99 AUD be added to the remote mobile phone’s balance), and so usually there is a predefined set of allowed values for each mobile network.

This list depends not only on the target currency, but sometimes also on the details of the arrangement with a given mobile operator, e.g., for the Aircel network in India the allowable values might be 500, 1000 and 5000 rupees, while for the Idea! mobile network (also in India) they will be 200, 400, 800 and 2000. So if a chosen “target” amount is converted into the “debit” amount using only the exchange rate, it will most likely result in an awkward number with decimal digits. Clearly, in most situations you will want to announce a nice “round” number to the user, i.e. the IVR announcement, “Your account will be debited fifty-four dollars” is better than “Your account will be debited fifty-three point thirty-seven dollars.” In order to address all of these challenges, the PortaSwitch administrator configures a special “mapping” tariff that flexibly defines the amounts allowed to be added to a remote user’s balance and the corresponding amount to be debited from a PortaSwitch account. For instance, in order to allow customers with balances in USD to transfer 2,000 Indian rupees to a remote user on a mobile network, the following will be done:

- The administrator creates destination INR2000.

- Then he creates a special tariff (in USD currency and using the Messaging service) that will be used to authorize mobile remittance operations for customers with balances in USD.

- Finally, this tariff’s administrator will create a rate for destination INR2000 and specify the Unit Price as the amount that should be debited from the donor’s account – in this case, 2,000 Indian rupees is about US $39, so taking into consideration exchange rate fluctuations, remittance processor markups and his own profit, the administrator will set the value at $45.

- By setting only certain “allowable” transfer values, the administrator can ensure, for instance, that transactions are not too small (where overhead is too high) or too large (where risk of fraud is too high), even if such too small/large top-up amounts are offered by the remittance processor.

- When a customer attempts to initiate a transfer to a phone number (91111111111), PortaSwitch queries the payment remittance server as to whether a transfer to this number is possible (it could be that the number is in a country where the remittance service is not yet available, or it is not a mobile phone number, but a landline).

- Then a list of allowable top-up amounts is retrieved and for each of them the authorization tariff is checked; the customer will only be offered the amounts that are listed.

- The customer selects the desired top-up amount, and after he approves the announced amount to be debited PortaSwitch sends a request to the remittance processor to initiate the top-up and debits the amount from the customer’s account.

Payment remittance system configuration

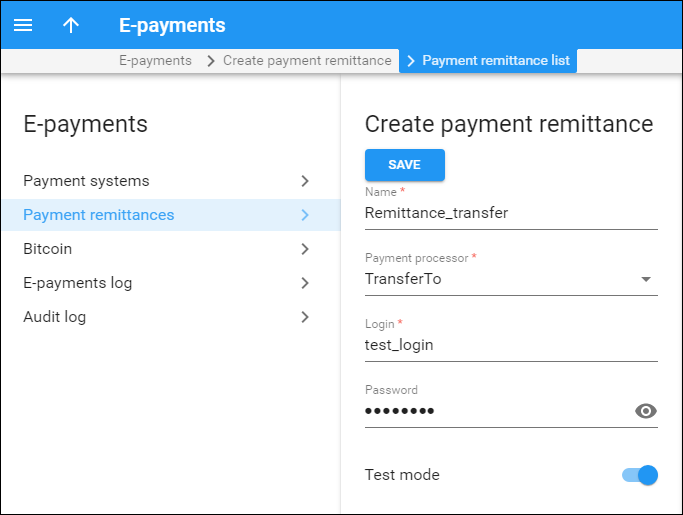

- Create a payment remittance system with the TransferTo processor on the Payments page.To add a new payment remittance system, click

Add and enter the account name, login, password and processor in the edit row at the top of the listing.Test Mode is a special mode of interaction with the system. It is useful during the initial setup phase, when you may want to test the setup without actually transferring funds.

Add and enter the account name, login, password and processor in the edit row at the top of the listing.Test Mode is a special mode of interaction with the system. It is useful during the initial setup phase, when you may want to test the setup without actually transferring funds.

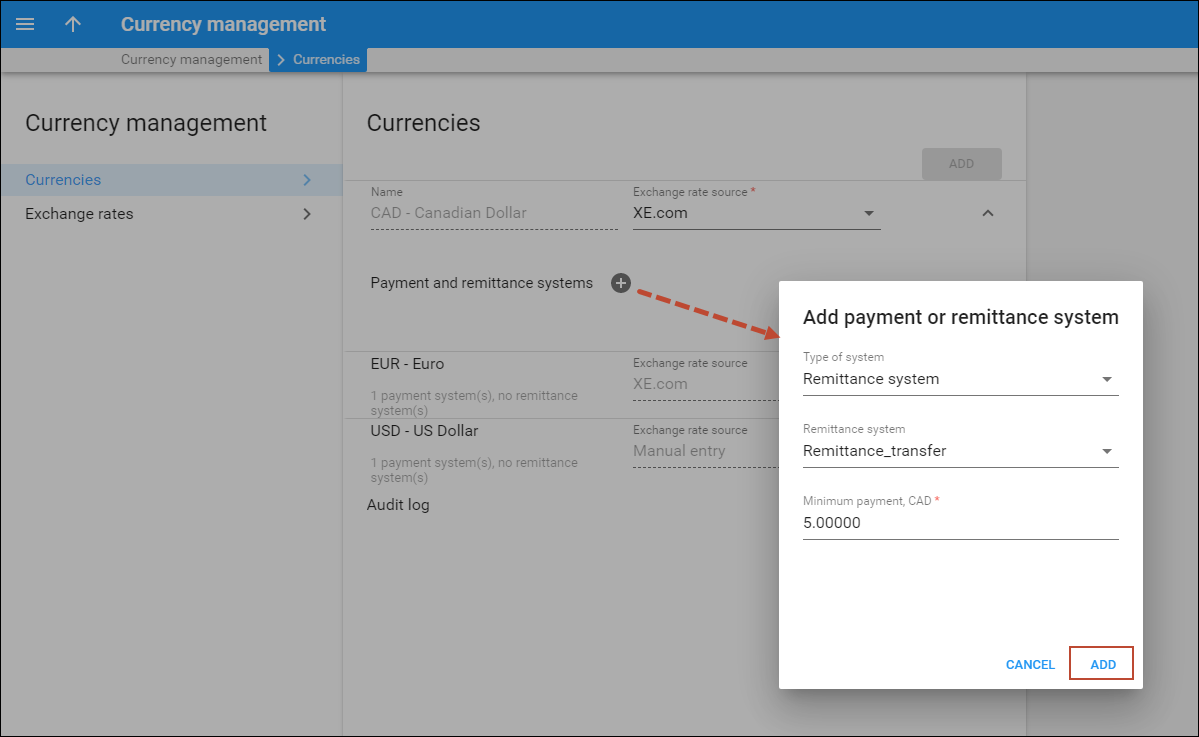

- Define the appropriate currency to the payment remittance system on the Currencies page.Click

Add and fill out the relevant fields. Select the corresponding payment remittance system.

Only those customers who maintain their balance in the currency for which the remittance system is defined will be able to transfer funds.

Add and fill out the relevant fields. Select the corresponding payment remittance system.

Only those customers who maintain their balance in the currency for which the remittance system is defined will be able to transfer funds. - Available transfer amounts for users of mobile operator services in various countries are provided by TransferTo in the currency of the destination country. Add the corresponding amounts on the Destinations page in the following format: CCCNNN, where CCC is the currency code and NNN is the amount, e.g., IDR50000, INR500, CNY100 etc.

- A specific tariff should be created for each currency assigned to a payment remittance system on the Currencies page. It will only be used for customers sharing the same currency. Create the following tariff:

- Name – the tariff name depends on the currency; define the name in this format: TransferToCCC (e.g., TransferToUSD) where CCC is the currency assigned to the corresponding payment remittance system.

- Currency – use the same currency as that used for the tariff name.

- Service – choose Messaging Service here.

- Add rates to this tariff with the amounts your customers will be able to transfer:

- Rate Codes – choose the destination created in step 3 (e.g., IDR50000, INR500, CNY100, etc.) for the allowable top-up values.

- Unit Price Initial – in this field, specify how much you want to charge the donor’s account for this transfer.

Note that you can only set one fixed price for a ‘currency’–‘amount to transfer’ pair, although TransferTo may charge differently for transferring funds to recipients in different countries or to recipients of different mobile operators within the same country.

For example, TransferTo will charge $5.40 for transferring $5.00 to a recipient of AT&T in the United States and $6.20 for transferring $5.00 to a recipient of BellSouth in Panama. Therefore, it is best to set up a price (the amount to be debited from the donor’s account) which allows for the difference in transaction fees for various recipients.

Using the payment remittance system

Customers can transfer funds in one of two ways: via the account self-care web interface, or by a special application access number. The recipient is specified and identified by the phone number. The full list of amounts available for transfer is obtained from TransferTo, but only amounts present in the corresponding tariff that are within the customer’s available balance are available for transfer.