PortaBilling allows payments to be processed online, without the intervention of a service provider, by charging the customer’s credit card or debiting their bank account. Payments may be initiated:

- By your customers from the web interface.

- By PortaBilling automatically (these are called “auto-payments”).

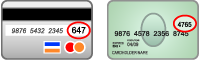

CVV

CVV (card verification value, also known as card security code (CSC), card verification code (CVC), and by some other names):

A CVV verification is a common safety measure for online payments, and in many cases a merchant acquirer, a payment processor or/and an ITSP as a merchant will request a CVV to be included with transactions. The only drawback of the mandatory card security code verification is that the end user or admin must enter a CVV each time they make online payments and, consequently, auto payments cannot be configured either.

Find the configuration details in the Payment configuration section.

Token-based payments

In the case of token-based payments, a payment processor stores the credit card data (or other payment information) and issues a token instead. A token does not contain actual credit card data but serves as an identifier of the card for the payment processor. PortaSwitch stores this token, and sends it to the payment processor when an end user pays for a service online. Based on the token, the payment processor retrieves the required payment data and then completes the transaction.

Storing tokens, as opposed to storing credit card data, doesn’t require you to obtain a PCI DSS or similar security certification, so you can launch the service almost immediately.

For token-based payments, credit card information (including CVV) must be included only with the initial transaction on each new credit card. Once the transaction is successful, the payment processor issues a token for this card. Subsequent transactions are made using the token, and additional card security code verification is not required. Thus, when token-based payments have been configured, you can offer your customers using such feature as auto payments.

For the list of payment processors that PortaBilling supports token-based payments for, please refer to Supported online payment processors section.

The scenario is the same as in Payments with card security code verification. The only difference is that ITSP now recognizes that token-based payments for Authorize.Net are supported by PortaBilling and therefore uses this functionality.

Find the configuration details in the Payment configuration section.

Auto payments

Auto payments (also called recurring payments) are automatically charged to end users’ credit cards and applied to their balances. This helps to improve the payment process for both the end user and the service provider as it is convenient and requires minimum effort on either part.

Find the configuration details in the Auto payments section.