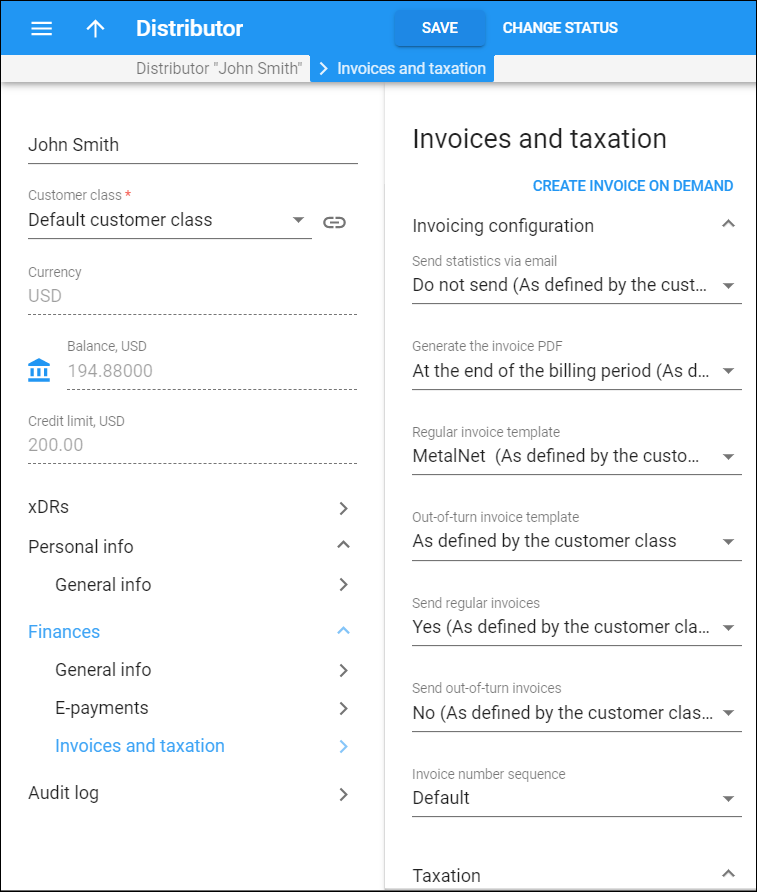

On the Invoices and taxation panel you can define which invoice template to use and how to enumerate the invoices, how to tax the distributor for operations, and whether to send statistics and invoices by email.

Here you can also create invoices on demand for the distributor.

Create invoice on demand

Use invoices on demand to charge the distributor immediately for the service usage, equipment purchase, etc. without waiting for the current billing period to close. This way you save the distributor's time and provoke early payments.

You can generate these invoices on demand:

-

Initial invoice, which includes charges for the first billing period. You can generate this invoice for the distributor during their first billing period only. From then on, use Midterm invoices.

-

Midterm invoice, which covers the charges from the beginning of a current billing period up to the time of the invoice generation.

-

Out-of-turn invoice, which includes manual credit/charge transactions.

The invoice wizard guides you through the configuration steps to generate invoices on demand. It includes these steps:

-

Invoice type, where you select which invoice to generate;

-

Fees, where you review applicable fees and add new ones manually;

-

Invoice review, which shows the invoice summary and where you define the payment terms and due date.

-

Payment, which provides the payment options.

Invoicing configuration

In the Invoicing configuration section you can define which invoice template to use, how to enumerate the invoices, and whether to send statistics and invoices by email.

To configure invoicing, expand the section.

Send statistics via email

Define which statistics to deliver to the distributor by email once the billing period ends.

-

Select As defined by the customer class to use the settings defined for the customer class.

-

Select Full statistics to send a .csv file with a complete list of xDRs.

-

Select Summary only to send only a brief summary of charges.

-

Select Do not send to not deliver any statistical data to the distributor.

Generate PDF invoice

Define whether to generate a .pdf file of the invoice for this distributor.

-

Select As defined by the customer class to use settings defined for the customer class.

-

Select At the end of the billing period to generate a .pdf file at the end of the billing period.

-

Select Postponed, based on resource availability to generate a .pdf file when PortaBilling completes calculations related to the previous billing period for all distributors.

-

Select On demand to generate a .pdf upon request.

Regular invoice template

Choose a regular invoice template for this distributor.

-

Select As defined by the customer class to use the regular invoice template defined for the customer class.

-

Select Do not create invoice to prevent regular invoice generation for this distributor.

-

Choose a predefined regular invoice template from the list.

Out-of-turn invoice template

Choose an out-of-turn invoice template for this distributor.

-

Select As defined by the customer class to use the out-of-turn invoice template defined for the distributor class.

-

Select Do not create invoice to prevent out-of-turn invoice generation for this distributor.

-

Choose a predefined out-of-turn invoice template from the list.

Send regular invoices

Define whether to send regular invoices to the distributor by email.

-

Select As defined by the customer class to use the settings defined for the customer class.

-

Select Yes to send regular invoices by email.

-

Select No to not send regular invoices by email.

Send out-of-turn invoices

Define whether to deliver out-of-turn invoices to the distributor by email.

-

Select As defined by the customer class to use the settings defined for the customer class.

-

Select Yes to send out-of-turn invoices by email.

-

Select No to not send out-of-turn invoices by email.

Invoice number sequence

Define how to number the invoices for this distributor.

-

Select Default to keep the default invoice numbering sequence for the whole environment.

-

Select Individual for environment to use the global sequential numbering (throughout the environment).

-

Select Individual for distributor to use the individual sequential numbering for this distributor's invoices.

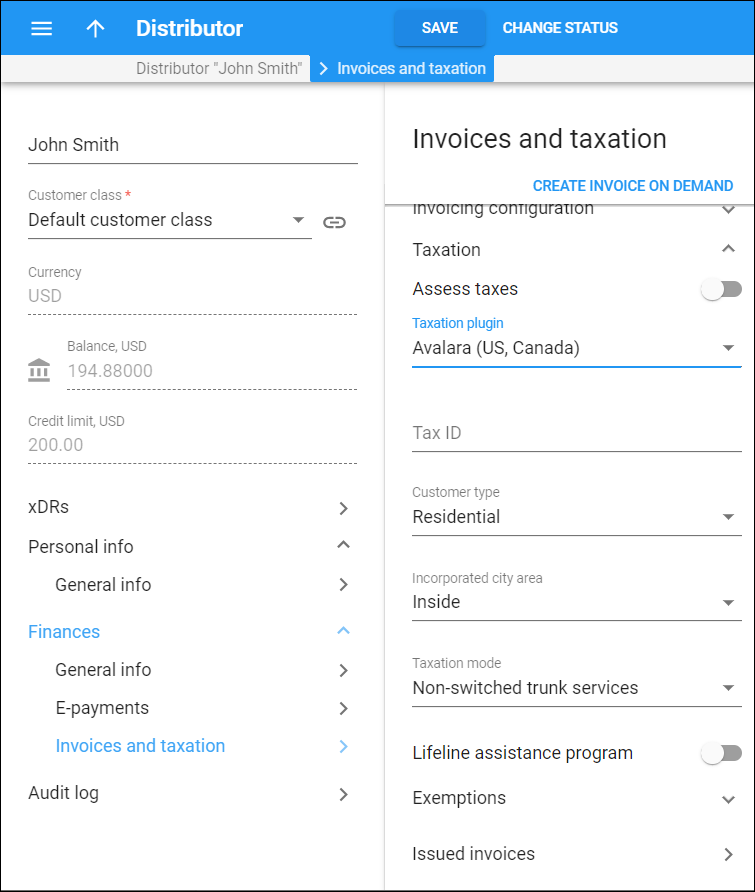

Taxation

In the Taxation section you can define how to tax the distributor for the services provided.

Taxation plug-in

Choose a taxation plug-in to use for calculating taxes.

Avalara (US, Canada)

Define the parameters for the Avalara plug-in.

Tax ID

Define the distributor's tax ID.

Customer type

Choose the type of distributors to whom you provide the services.

-

Select Industrial for manufacturing companies.

-

Select Business for business entities that use the services for business purposes.

-

Select Residential for distributors who use the services for personal purposes.

Incorporated city area

Define a distributor location:

-

Select Inside for distributors located inside an incorporated city area.

-

Select Outside for distributors located outside of an incorporated city area.

Taxation mode

Define which additional taxes to calculate for the distributor:

-

Select Non-switched trunk services to calculate axes on the quantity of DID numbers the distributor uses.

-

Select Switched trunk services to calculate taxes for the number of distributor sites, extensions and an cloud PBX distributor's simultaneous outgoing calls.

Lifeline assistance program

Enable this toggle whether the distributor is entitled to a lifeline assistance program.

Exemptions

Choose which taxes the distributor is exempt from.

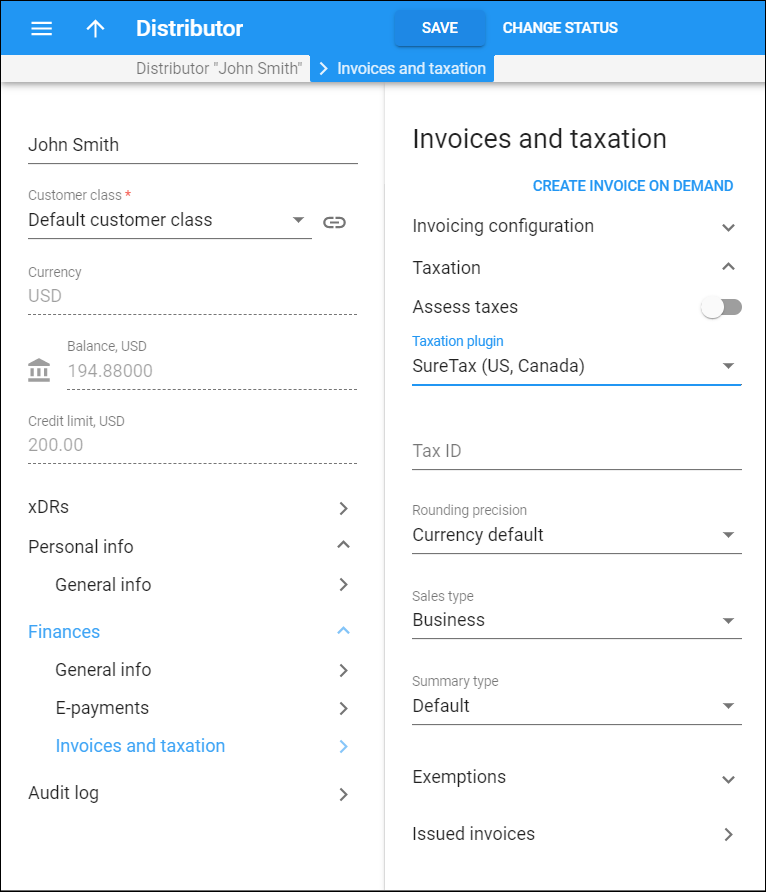

SureTax (US, Canada)

Define parameters for the SureTax plug-in.

Tax ID

Define the distributor's tax ID.

Rounding precision

Choose the number of decimal places for rounding out the taxes.

Sales type

Choose the type of distributors for whom you provide the services.

-

Select Default to apply customer class settings.

-

Select Business for business entities that use the services for business purposes.

-

Select Industrial for manufacturing companies.

-

Select Lifeline for distributors granted a subsidy.

-

Select Residential for distributors who use the services for personal purposes.

Summary type

Choose how to display taxes in the distributor invoices:

-

Select Default to apply customer class settings.

-

Select No summary to separately display federal, state and local taxes.

-

Select Summary by Federal, State and Local Taxes to display federal, state and local taxes summarized.

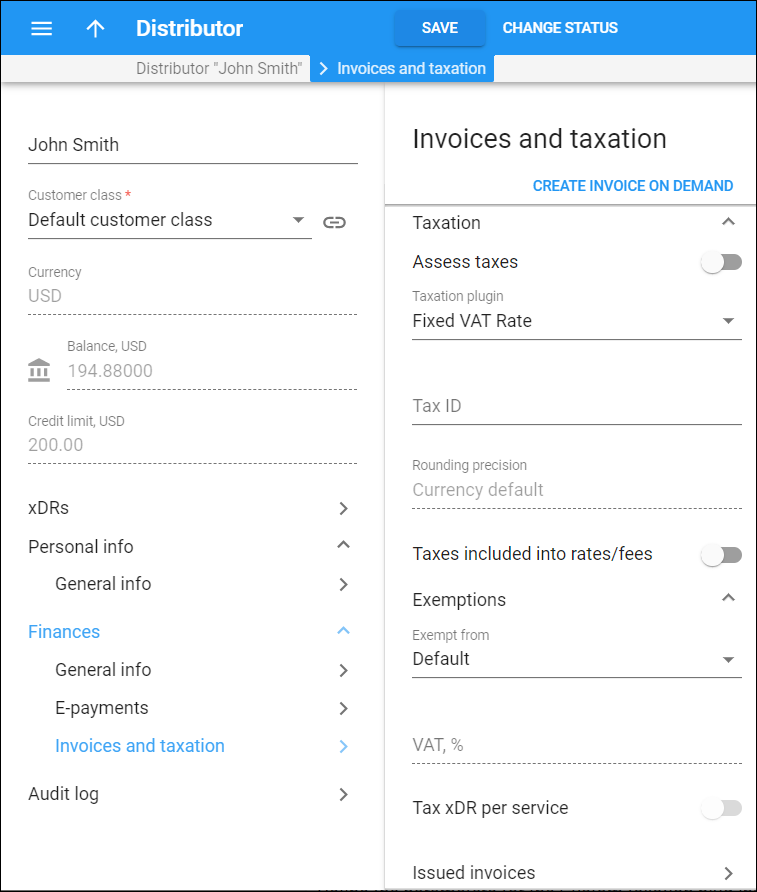

Exemptions

Click Add exemptions to choose which taxes the distributor is exempt from.

Fixed VAT Rate

Define the parameters for the Fixed VAT rate plug-in.

Tax ID

Define the distributor's tax ID.

Taxes included into rates/fees

Choose whether to include taxes in the rates. When taxes are included, PortaBilling back-calculates the defined tax percentage from the total amount of charges or payments. Otherwise, PortaBilling adds a defined percentage of value-added tax to the charges.

Exempt from

Define whether the distributor is excused from taxes:

-

Select Default to apply customer class settings.

-

Select Yes if the distributor is not required to pay this tax.

-

Select No to apply a fixed VAT rate to this distributor.

VAT, %

Type a certain percentage of value-added tax.

Tax xDR per service

Choose whether to calculate taxes per service and include them on invoices. This option is applicable if your rates do not include taxes

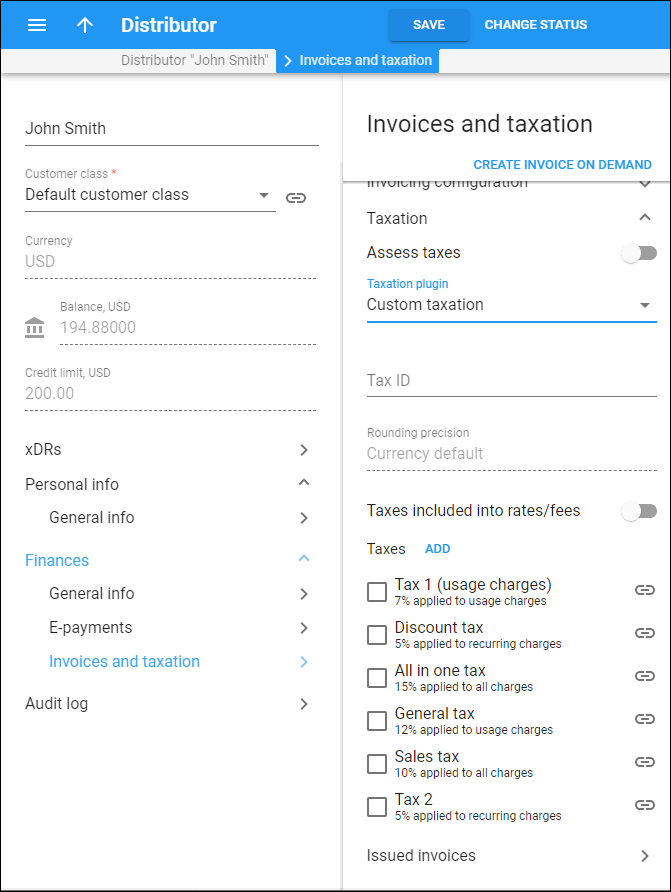

Custom taxation

Define the parameters for the Custom taxation plug-in:

Tax ID

Define the distributor's tax ID.

Taxes included into rates/fees

Choose whether to include taxes in the rates. When taxes are included in the rates, PortaBilling back-calculates the defined tax percentage from the total amount of charges or payments. Otherwise, PortaBilling adds a defined percentage of value-added tax to the charges.

Taxes

Choose which custom taxes to apply to this distributor. The list shows all custom taxes you created on the Taxation > Customized taxes panel. You can create a new custom tax right here:

-

Click Add.

-

In the Create a new customized tax window, specify the tax name and percentage rate.

-

Select what charges this tax applies to: all charges, only usage charges or only recurring charges (subscriptions).

-

Click Save. The tax appears in the list.

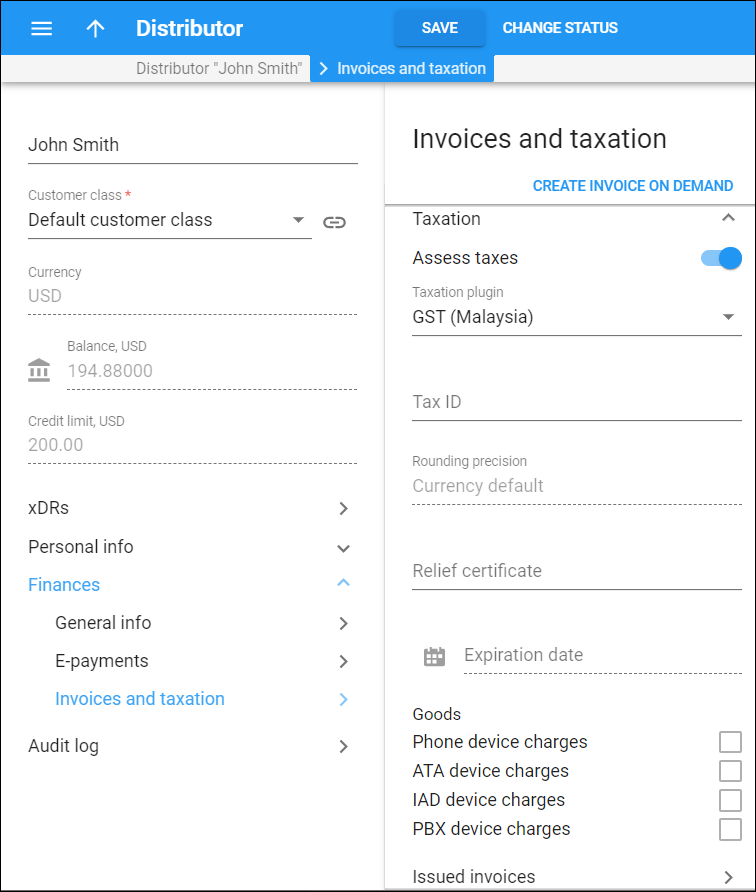

GST (Malaysia)

Define parameters for the GST (Malaysia) plug-in:

Tax ID

Define the distributor's tax ID.

Relief certificate

By default, the GST plug-in applies a 6% goods and services tax. If the distributor has a relief certificate code that applies a 0% tax for goods, type the code in this field.

Expiration date

Choose the distributor's relief certificate expiration date.

Goods

Choose the goods that fall under the relief certificate for which 0% tax applies.

Issued invoices

The Issued invoices links leads to the Invoicing section where you can browse and manage the distributor's invoices.