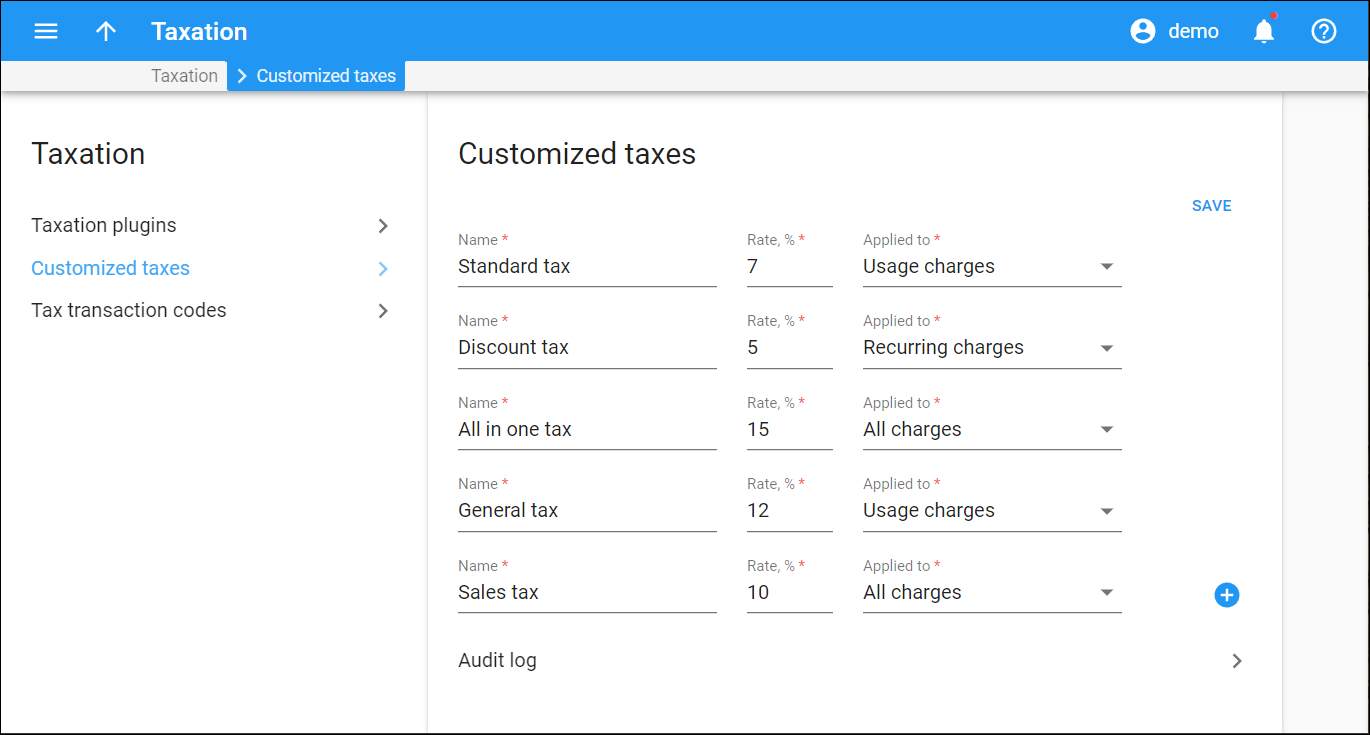

On this panel, you can add new customized taxes and modify the existing ones. You can choose which of these taxes to apply when configuring custom taxation for a customer class or for an individual customer.

To add a new customized tax, click Add and fill in the following fields:

-

- Name – type a descriptive name of the tax (it will be shown in xDRs and in taxation configuration for a customer or a customer class).

- Rate – type a percentage rate value for this tax.

- Applied to – choose whether this tax will be applied to:

- All charges – all charges including subscriptions and credits/adjustments.

- Usage charges – all charges except for subscriptions and credits/adjustments.

- Recurring charges – only to subscriptions.

To save changes, click Save.

To remove a specific tax from the list, hover over it and click Remove . You can’t remove a tax that is already being used for custom taxation for a customer or for a customer class.

Audit log

Link copied to clipboard

Open this panel to trace the changes made to customized taxes.