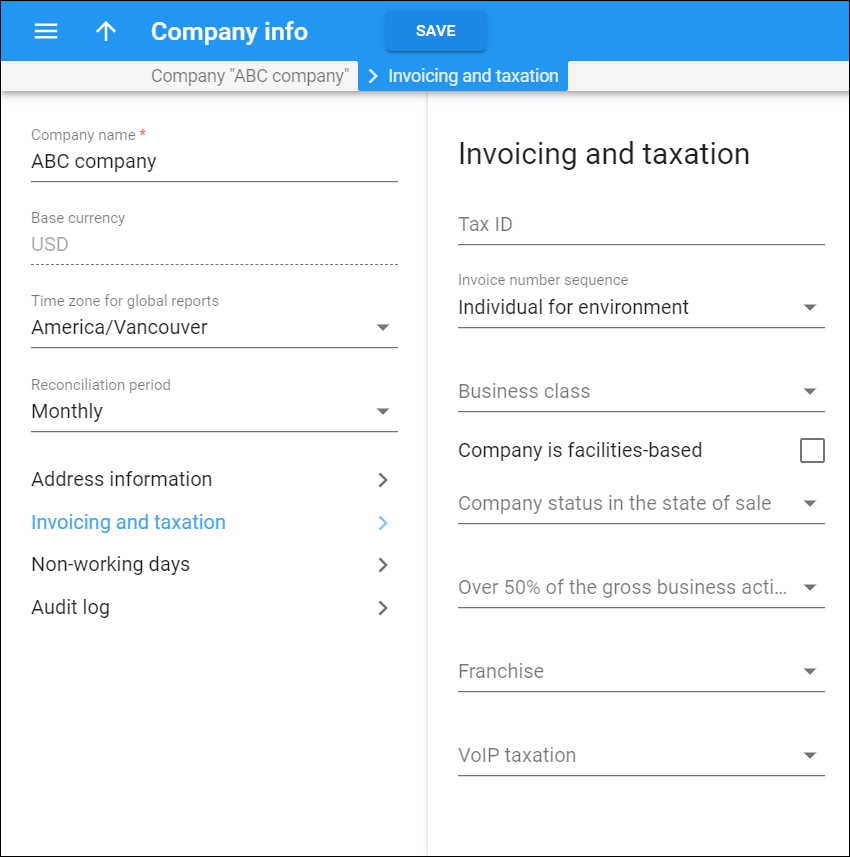

Specify the Tax ID and select your preferred Invoice number sequence.

If the Avalara plug-in is enabled, you also see fields that allow you to specify your taxation settings. Note that the Avalara module must be configured on the Configuration server. Please refer to the Tax calculation via Avalara section for details.

Tax ID

Specify your locally designated tax number in this field.

Invoice number sequence

PortaBilling can generate invoices for all their customers distributed throughout the environment by using sequential invoice numbering. In some cases, you may want to use more than one sequence of numbers if, for example, legislation demands strict sequential invoice numbering for each customer or reseller.

Specify the default invoice number sequence for your environment:

-

Individual for Environment – sequential invoice numbering throughout the environment.

-

Individual for Reseller – sequential invoice numbering throughout the environment for direct customers, distributors and resellers, even though the reseller uses their own sequential invoice numbering system for all of their customers.

-

Individual for Customer – every customer (direct customer, distributor, subcustomer and reseller) has their own sequential invoice numbering.

Business class

This describes you as the service provider. Select one of the following options:

-

ILEC – this is a telephone company that owns most of the local loops and facilities in a serving area.

-

CLEC – this is a company that builds and operates communication networks within areas, providing its customers with an alternative to the local telephone company within the existing ILEC's territory.

Company is facilities-based

Select if you own or control facilities (e.g., switching equipment and transmission lines) for providing telecommunication services.

Company status in the state of sale

Select whether you and the services you provide are regulated by the regulatory commission in the state where the services are provided.

Over 50% of the gross business activities in

Define your primary activity:

-

Local Service Revenue – select this option if you receive more than 50% revenue from local calls.

-

Long Distance Revenue – select this option if you receive more than 50% revenue from long distance calls.

Franchise

Select whether you provide services according to a franchise agreement.

VoIP taxation

Specify the method to tax your VoIP services:

-

Normal – this is a conservative method; it returns taxes on VoIP-related transactions/service type codes. VoIP services are taxed using Transaction code 19.

-

Aggressive – this method does not return taxes on VoIP-related transactions/service type codes. VoIPA services are taxed using Transaction code 20.