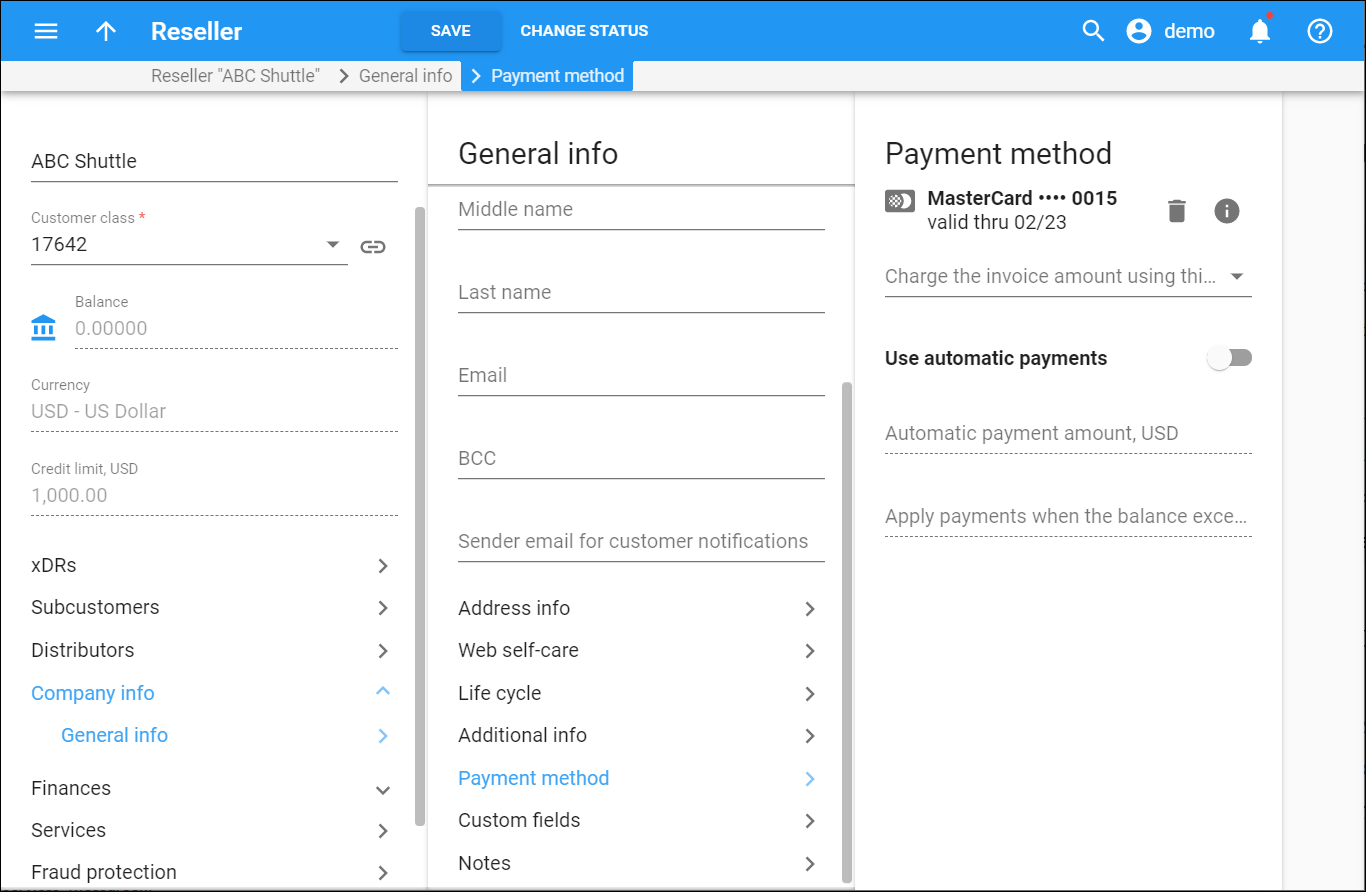

On this panel you can define the reseller’s preferred payment method and configure automatic payments.

Supported payment methods

|

|

|

|

|

|

|

Configure a preferred payment method

- Select Add method.

- Specify the payment details.

- Select Add.

To remove a payment method, click Delete .

To review the payment details, click .

The choice of available payment methods depends on the online payment processor that you select for a payment system. Note that a currency must be identical for the reseller and the payment system.

To create a payment system, go to Financial > E-payments > Payment systems.

For more information about supported online payment processors, see PortaBilling Administrator Guide.

Charge the invoice amount using this method

Specify whether to use this method to pay the invoice.

Use automatic payments

Turn on the toggle switch to enable automatic payments. Then the reseller’s credit card will be charged when the billing period closes and the invoice is generated. Make sure the Charge the invoice amount using this method option is set to Yes.

Automatic payment amount

This is the amount of money that is charged when the reseller’s balance crosses a threshold.

Apply payments when the balance exceeds

This is a threshold. Specify an amount of money. When the reseller’s balance crosses this threshold their credit card is charged for the amount specified in the Automatic payment amount field.

Automatic payments without storing credit card info

You can set up auto payments for payment systems that:

- support tokenization for payment processing, or

- don’t support tokenization and don’t require the CVV code

Using tokens

Some payment processors can store credit card information securely on their servers. They do this by generating a token after the initial transaction. The token is not the credit card information but an identifier for it, and the token can be used for subsequent payments.

If the payment system is configured to use tokens for payments, this section appears only once the payment processor returns the token and it is saved by PortaBilling. Since the payment processor returns a token upon the first successful transaction with a new credit card (or other supported payment method), at least one manual transaction must be successfully completed for the auto payments section to become available.

PortaBilling supports token-based payment processing for Secure Hosting and Payments, Authorize.Net, Payment Express and Virtual Card Services payment processors.

Payment systems that require user redirection to their website

Recurring (automatic) payments are not supported for the payment systems that require user redirection to their website, e.g., PayPal.

Payments with Bitcoin

Bitcoin crypto currency offers anonymity. When a Bitcoin transaction takes place, no personal identifying information such as name or address are required. This makes paying with Bitcoin convenient for those customers who care about their privacy and want it preserved.

For more information about Bitcoin support in PortaBilling, see PortaBilling Administrator Guide.

Retention restrictions

IMPORTANT! A merchant may not use account and transaction information for any purpose other than assisting in the completion of a payment card transaction, or as specifically required by law. Merchants may collect a payment card number and expiration date independently of a payment card transaction only with the express consent of the cardholder. A merchant may only retain this information for the sole purpose of facilitating future payment transactions. A merchant must not provide this information to any other person, except for the sole purpose of assisting in the completion of a payment card transaction.